When there’s blood on the streets, buy property. Or a competitor. Among many uncertainties, the COVID-19 pandemic set one thing straight: there is no perfect recovery scenario for any carrier around the world, but those who were facing issues prior to the travel restrictions are fighting an incredible uphill battle. Thus the axiom, old as the sun, is still true.

Avianca is a late-arrival guest to the consolidation party, as is setting the stage to integrate with Brazilian GOL under Abra Group, a holding that will be based in the United Kingdom once it gets all required approvals. The carrier just exited a painful Chapter 11 process that restructured its debt and provided a liquidity that is close to 1 billion after rising 1.7 billion dollars in capital.

Like most successful emerging Chapter 11 stories -and Avianca has more than one of those to share-, the company states that this process made it more efficient, financially stronger, and highly competitive.

With plans to double its fleet and route network, and a hybrid product that combines «the best attributes of the low-cost model» with the «key differentials» of its «traditional offer», we are yet to see how those ambitious plans will materialize. It’s like those toxic relationships that give it a second, third or fifteenth run, expecting that this time will work. Hey, at least they’re trying to change.

Viva Air Colombia’s fairy tale had a sugar rush last April when it was announced that Avianca made an offer the low-cost simply couldn’t refuse: to take financial and operational control of its Colombian and Peruvian subsidiaries, pending all required approvals.

In fact, Avianca Group International Limited, headquartered in the United Kingdom (different than Avianca Holdings, which was headquartered in Panama and liquidated as it was the previous Chapter 11 entity) injected a significant amount of money in Viva and created a complicated structure for competition regulators not to confuse themselves: this thing with Viva is not a merger. It´s an integration. Just like President Lisa Simpsons’ temporary refund adjustment must not be confused with a painful emergency tax.

But regulators didn’t buy it and ruled against the operation, stating that it would create a monopoly in the Colombian market and simply eliminate competition in some routes. A Viva-Avianca integration -let’s play along and call it that way- transported in 2021 almost 15 of a market that totaled 24 million passengers.

Avianca appealed the decision and proposed a significant divestment in Bogota, its main domestic hub, but that may not be enough for Aerocivil to change its mind. Besides, there’s another factor that is even more pressing: time. Richard Galindo, Avianca’s Chief Legal Officer, was crystal clear when he said that if the Colombian authority doesn’t resolve the appeal in record time, it could be too late for Viva.

But what is Avianca buying when entering Viva? Despite its exponential growth in Colombia’s domestic market and its international expansion, the low-cost carrier has been struggling financially and has reduced its presence in Peru, a subsidiary that suffered from tight travel restrictions and the arrival of SKY and JetSMART, competing to fill the void Avianca left when suspended its operations.

Now in a complex economic scenario that includes inflation, rising costs and a worsening exchange rate as Colombian Peso deprecates, Viva entered the final stages of its survival mode, but the future doesn’t look good. And that’s without considering that JetSMART has just been given authorization to open a subsidiary. So, what’s so valuable in what’s left of Viva for Avianca to want it so bad?

It is undoubtedly true that the no-frills model that Viva pushed down Colombia’s aviation market throat forced Avianca to make significant changes in its own offer, facing a significant resistance of its customer base. The backlash of the new fare tiers, ancillary offering and even catering and seat reconfiguration has been fierce and made more than a dent in the one-hundred-year-old brand. For any other operator, cutting costs is a smart move. For Avianca, it meant cheapening. There’s a difference.

In a first glance, anyone can think that by integrating Viva, Avianca acquires the low-cost business model that it has struggled to implement. But in a way, integrating Viva while keeping its brand is the simplest way to embrace the one thing they crave for a true hybrid offer that protects Avianca’s name and reputation. A «guilt-free low-costing» strategy, if there’s such a term.

The real question is how much Avianca is willing to pay for that advantage. Is renouncing more than a hundred slots in Bogota just when a deep-pocket competitor -and with a business model that already hurt Avianca- is arriving to the market a good strategy? It is sure better than letting Viva fail and trying to conquer its 20 percent market share without the proper tools. But there’s no easy win for Avianca here. Either if it gets what it wants, or if it does not get it at all.

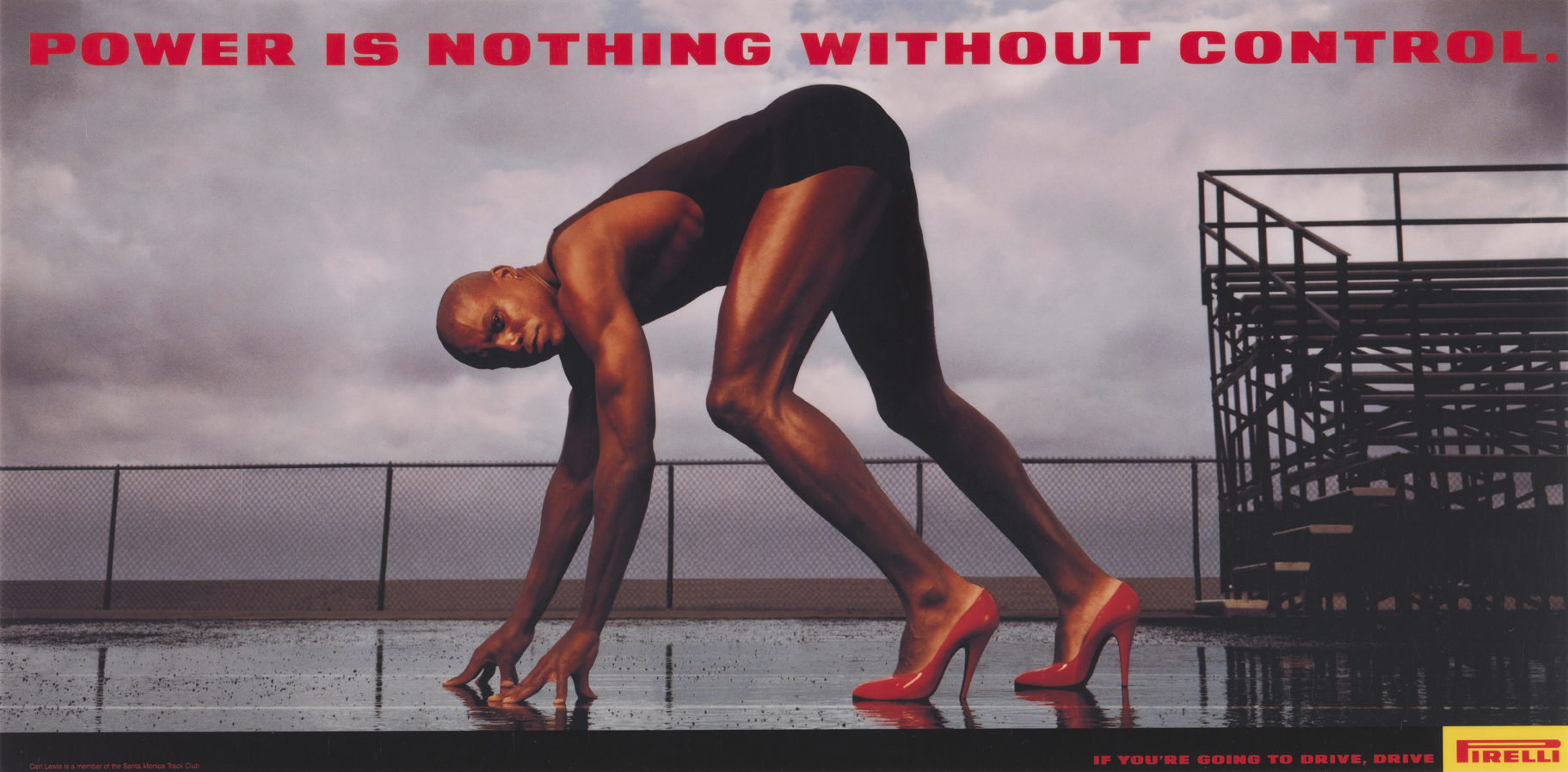

Remember that Carl Lewis’ Pirelli ad? Adrian Neuhauser said it a couple of days ago: it would take months or even years to gain Viva’s share. But if Viva goes bust and that race is on, Avianca will be forced to run with stilettos.