GOL Linhas Aéreas, Brazil’s leading domestic airline, unveiled today its 5-Year Financial Plan, which will serve as the basis for the company’s independent legal plan under Chapter 11.

«We are pleased to reach another important milestone in our financial restructuring process,» said Celso Ferrer, CEO of GOL. «Since the beginning of this process, GOL has continued to operate without interruptions, demonstrating solidity in executing our commercial strategy and cost management. We have successfully renegotiated agreements with our lessors for most of our aircraft and are investing in our engines and expanding our operational fleet.»

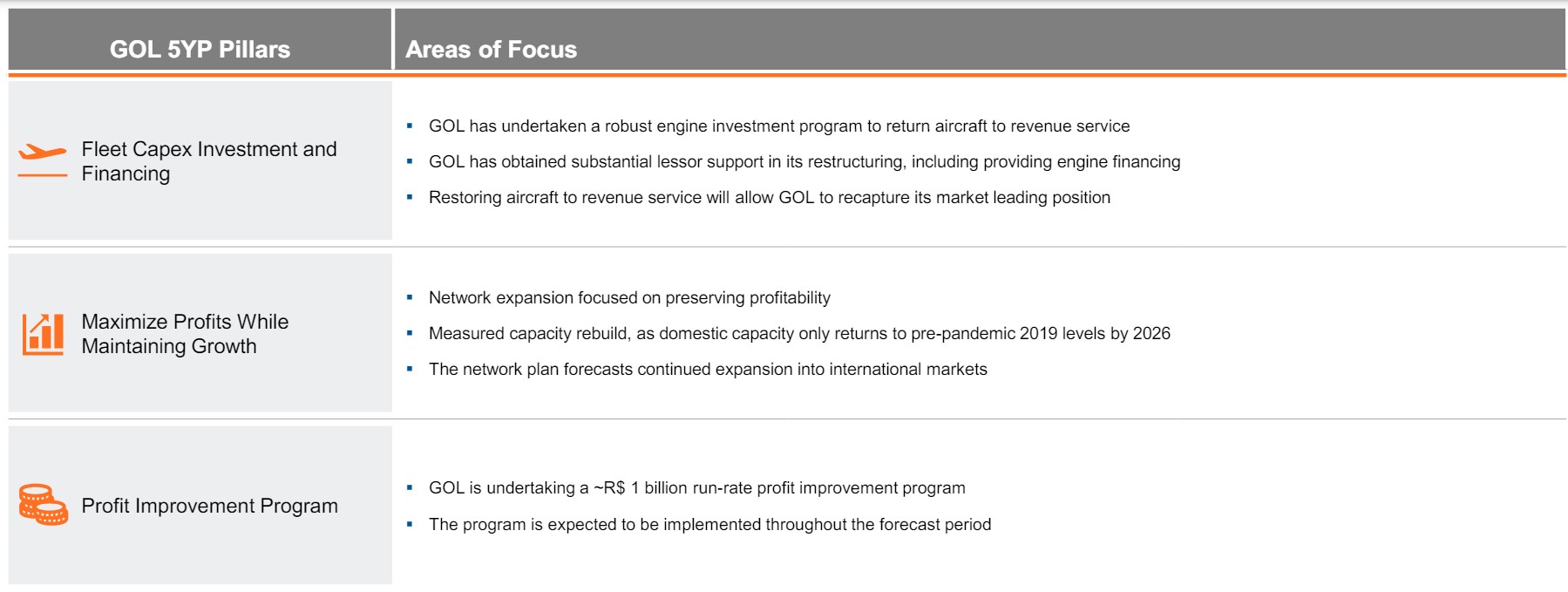

The GOL 5-Year Plan aims to return to pre-COVID domestic capacity levels by 2026 and expand its network both nationally and internationally. The forecast includes growing the fleet to 169 aircraft by 2029 and implementing an annual result improvement program of approximately R$ 1 billion.

EBITDA margins (expressed as a percentage of total revenue) are expected to decrease to approximately 23% in 2024, rising to around 34% by 2029. The company plans to raise capital by US$ 1.5 billion, which will help pay off the existing Debtor-in-Possession (DIP) financing and add liquidity to the balance sheet.

«With the balance sheet transactions contemplated in the five-year plan, liquidity levels are expected to reach approximately 18% and 25% of 12-month revenues («UDM») by the end of 2025 and 2029, and a net leverage ratio (measured as Total Debt less Liquidity/EBITDA) of approximately 3.6x, 2.9x and 1.7x in 2025, 2026 and 2029, respectively,» details the airline.

This news comes just days after the announcement of a historic codeshare agreement between Azul and GOL that could cement another type of relationship for the future.

Fleet Update and Exit Financing

As of May 24, 2024, GOL had agreements approved by the U.S. Bankruptcy Court for 113 aircraft and 48 spare engines. The company is evaluating concession packages offered by lessors for all remaining aircraft. The investment in engine overhauls will mean that capacity for 2024 will be temporarily below the 2023 level, with a rapid recovery in 2025.

GOL has begun discussions on the financing plan that will support its Reorganization Plan. The competitive process for exit financing will begin in early June and extend until the end of the third quarter of 2024. The plan involves refinancing approximately US$ 2.0 billion and injecting approximately US$ 1.5 billion in new capital through the issuance of new shares.

Download Documents