In October 2024, passenger traffic in Latin America and the Caribbean grew by 4.6% compared to the same month of the previous year, reaching a total of 38.7 million. According to the report by the Latin American and Caribbean Air Transport Association (ALTA), this increase represents 1.7 million additional passengers, driven primarily by growth in domestic and intraregional markets.

Demand, measured in revenue passenger kilometers (RPK), grew by 3.8%, while available seat kilometers (ASK) capacity increased by 3.3%. The load factor stood at 84.9%, improving by 0.4 percentage points compared to the same period last year. This indicator reflects an optimization in the use of available capacity, according to the report.

In October 2024, airlines operated 305,810 flights, a 3.4% increase compared to the same month of the previous year. Of these, 190,406 were domestic flights (+3%), and 115,404 were international (+4%). Total seat capacity reached 47.2 million, growing by 3.8%.

Table 1. Total passenger market in LAC – October 2024

| Metric | October 2024 | October 2023 | Growth 2024/2023 | Cumulative (Jan-Oct 2024) | Cumulative (Jan-Oct 2023) | Growth 2024/2023 |

|---|---|---|---|---|---|---|

| Passengers | 38,741,441 | 37,036,589 | 4.6% | 394,538,684 | 373,292,954 | 5.7% |

| Domestic | 22,297,430 | 21,271,512 | 4.8% | 210,761,721 | 205,589,163 | 2.5% |

| Intra-LAC | 4,725,450 | 4,329,596 | 9.1% | 45,816,831 | 40,586,352 | 12.8% |

| Extra-LAC | 11,718,561 | 11,435,481 | 2.5% | 137,960,132 | 127,082,806 | 8.6% |

| RPK (millions) | 79,486 | 76,577 | 3.8% | 833,327 | 774,630 | 7.6% |

| Domestic | 20,398 | 19,800 | 3.0% | 194,671 | 192,302 | 1.2% |

| Intra-LAC | 9,419 | 8,400 | 12.1% | 90,446 | 78,354 | 15.4% |

| Extra-LAC | 49,669 | 48,377 | 2.7% | 548,210 | 503,974 | 8.8% |

| ASK (millions) | 93,614 | 90,627 | 3.3% | 987,774 | 923,138 | 7.0% |

| Domestic | 24,516 | 23,544 | 4.1% | 237,404 | 234,514 | 1.2% |

| Intra-LAC | 11,543 | 10,573 | 9.2% | 112,916 | 97,316 | 16.1% |

| Extra-LAC | 55,554 | 56,510 | -1.7% | 637,454 | 591,308 | 7.8% |

| Load Factor | 84.9% | 84.5% | 0.4 pts | 84.4% | 83.9% | 0.5 pts |

| Domestic | 83.0% | 83.9% | -0.9 pts | 82.4% | 82.4% | 0.0 pts |

| Intra-LAC | 81.6% | 83.7% | -2.1 pts | 80.8% | 81.4% | -0.6 pts |

| Extra-LAC | 86.3% | 84.8% | 1.5 pts | 85.2% | 85.2% | 0.8 pts |

Source: ALTA analysis, based on Amadeus data and estimates, including information reported by member airlines.

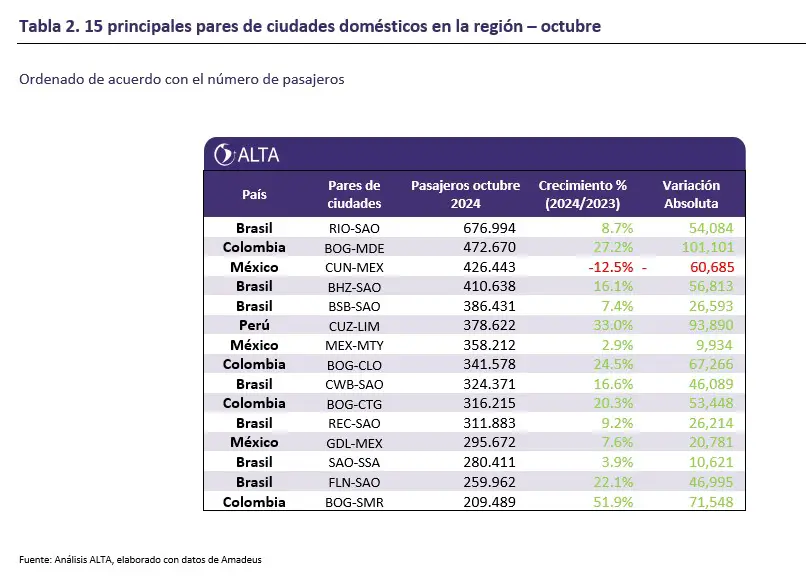

The domestic segment, which transported 22.3 million passengers, grew by 4.8% compared to October 2023, contributing to 60% of the total growth in the region. Brazil and Colombia led this segment, with 8.3 million and 2.9 million passengers, respectively.

In contrast, Mexico and Argentina faced declines in domestic traffic. Mexico reported a 4.2% drop in passengers (5.2 million) and a 6.2% reduction in flights. In Argentina, traffic fell by 12.6%, marking seven consecutive months of decline, with a total of 1.4 million passengers.

In Brazil, the Congonhas (CGH) – Santos Dumont (SDU) route remained the busiest, with 361,000 passengers, while in Colombia, the Bogotá (BOG) – Medellín (MDE) route stood out, reaching 472,670 passengers, a 27.2% increase.

In the intraregional market, traffic grew by 9.1%, totaling 4.7 million passengers. This increase, according to ALTA’s report, was led by the Brazil-Chile market, which experienced a 59.6% growth thanks to new frequencies on routes like Brasília (BSB) – Santiago (SCL). Another notable market was Colombia-Panama, which grew by 21.7% in passengers, driven by a 39% increase in frequencies on the Bogotá (BOG) – Panama City (PTY) route.

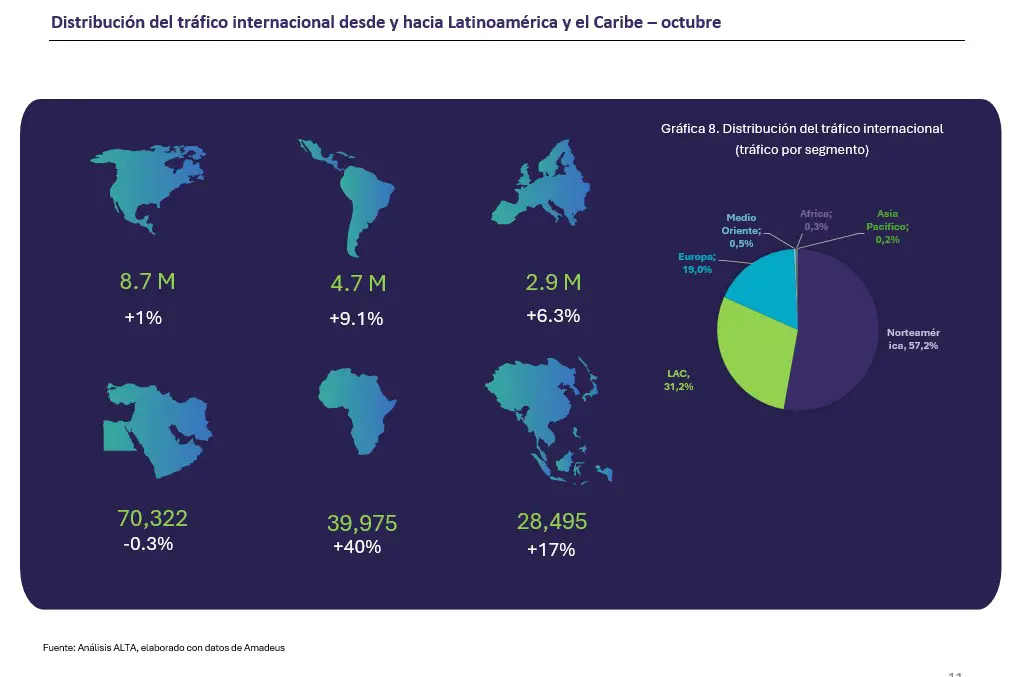

Moderate growth in international markets

International traffic reached 11.7 million passengers (+2.5%). Routes to North America accounted for the highest volume, with a 0.9% increase (8.7 million passengers). Connections to Europe grew by 6.3% (reaching 2.9 million passengers), with the Caracas – Madrid route standing out due to a 77% increase in frequencies.

Among extraregional markets, Brazil led absolute growth, registering 2.1 million passengers (+11.8%) and 1,030 additional flights. Routes to Spain showed strong dynamism, with a 37% increase in frequencies. In the Dominican Republic, international traffic grew by 3% (1.3 million passengers), despite a 6% decline in frequencies.

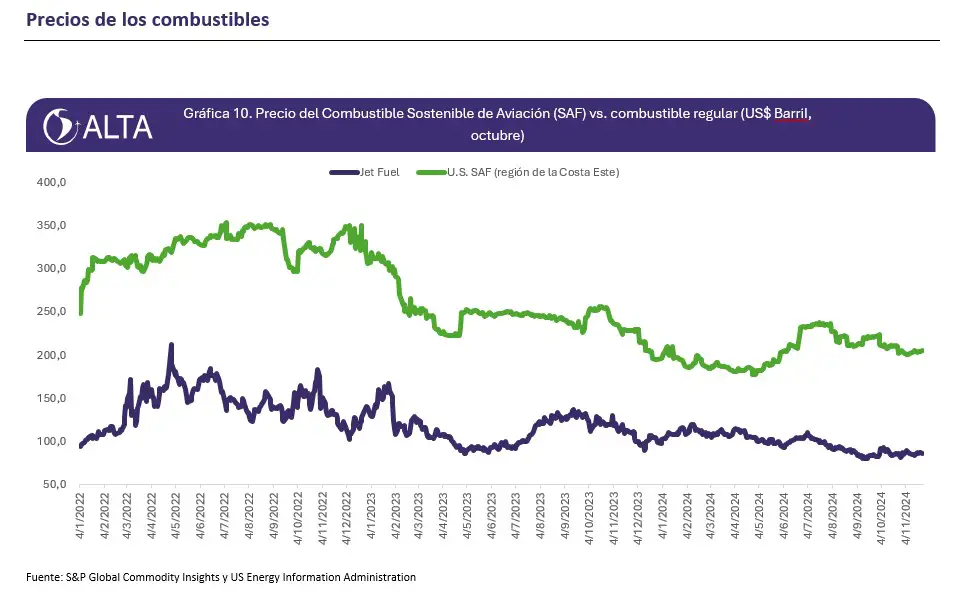

Impact of fuel prices

ALTA’s report also highlighted the evolution of fuel prices, a crucial factor for airlines. In November 2024, the average Jet Fuel price was USD 86.82 per barrel, with a peak of USD 89.59. This value represents a slight 0.02% decrease from October and a significant 24.7% reduction compared to November 2023.

The cost of Sustainable Aviation Fuel (SAF), on the other hand, was USD 203.58 per barrel, 2.3 times more expensive than conventional Jet Fuel. Despite a 3.1% decrease compared to October and a 12.1% year-over-year drop, the high price of SAF remains a challenge for the industry, which aims to balance sustainability and operational costs.