The situation in Romania was quite chaotic two weeks ago, at least as far as air transportation is concerned. Blue Air, citing the freezing of all its bank accounts by a state autarchy, canceled all of its flights between the afternoon of 6th of September through the 12nd of the same month.

While the accounts were unblocked the day after, the sales for dates after the cancellations saw such a huge reduction that, on the 9th, Blue Air said it would only restart its flights on the 10th of October.

Whether they actually restart their flights or not, the damage is made; most of its fleet has already been returned to the lessors and, according to Planespotters.net’s fleet database, only five 737s remain.

Before going under, this fleet had fourteen aircraft distributed between five bases. Of these, Turin in Italy, Cluj-Napoca and Iași in Romania had one based aircraft which; Bacău, Romania, had two; and Bucharest saw the rest.

This effectively meant that Blue Air held second place in the competitive Romanian market, in a honourable position ahead of Ryanair and even the local flag carrier TAROM — just behind Wizz Air.

And by doing so, it survived in the market as arguably the last independent low-cost carrier (of a considerable size, at least) in Europe.

The markets Blue Air served

Naturally, Bucharest was the airline’s stronghold. With nine based aircraft there, they flew to major cities, mostly serving the Romanian diaspora — in a financial statement during its COVID-19 bailout, the airline said this segment composed 70% of its customers.

As such, the airline held 17.7% of the capacity (by number of seats) in Otopeni Airport in the last full month of operations of Blue Air, according to Cirium’s Diio Mi application.

Of the other bases, the most affected by the interruption is Bacău, where Blue Air held 61.7% of the local seat capacity; the city is followed by Iași (18.6%), Cluj (11.6%) and Turin (4.8%).

Naturally, Cluj and Turin will face a smaller impact, especially because of the size of these cities, but Bacău, Bucharest and Iași should struggle more, for Blue Air is a major player in both cities.

Moreover, while both Ryanair and Wizz Air offered ”rescue fares”, Wizz snapped faster, adding five aircraft to its Bucharest base — of which one arrived, the airline said, less than a week after Blue Air’s halt.

Naturally, then Blue Air’s return, subject to their own conditions of their future cash position, will be even more difficult.

That’s because Ryanair and Wizz are known to be very protective of their own markets — let alone ones they dominate –, so for Blue Air, their rebound will only be more difficult, now that they let the two ULCCs capture what was their position.

Blue Air versus Ryanair and Wizz

To understand better the size Blue Air will face should they restart their flights, we can take a look at the numbers. And while Ryanair and Wizz usually published their quarterly results as a public company, the public only understood better the situation of Blue Air’s accounts when they were bailed out, for they needed to open their accounts.

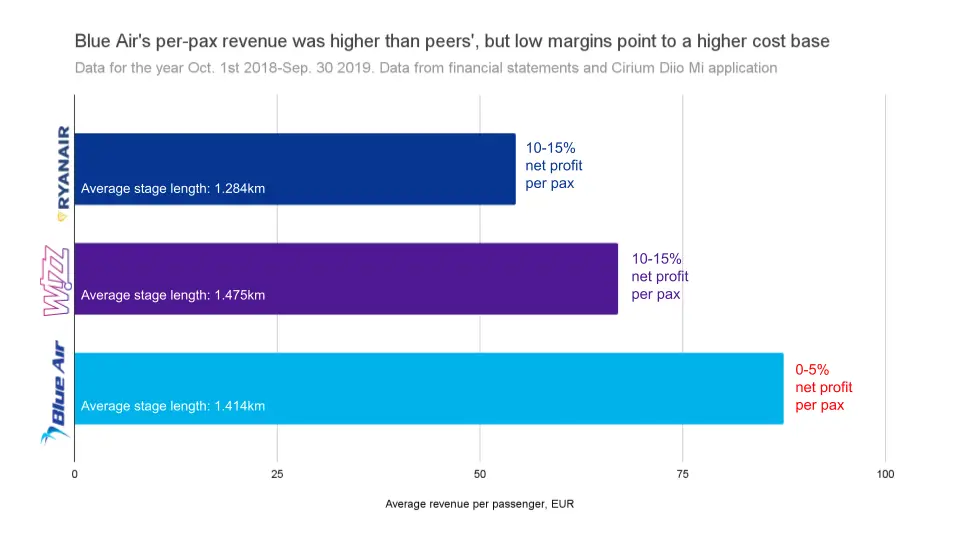

Now because Blue Air operated ACMI for a bunch of carriers, this distorted their cost results; but because their revenues were divided between fare revenue, ancillaries and «other» revenue, we can get their average revenue per regular passenger. The results are quite surprising.

In the year that went from October 1st, 2018 to September 30th, 2019, Blue Air was actually profitable, after years losing money. While Ryanair and Wizz scored margins of between 10-15%, Blue Air (in the months it broke even) reached it as far as 5%.

In fact, that year Blue Air managed to charge passengers way more than Wizz and Ryanair. The fact that their net margin per passenger was lower, then, show that their weakness ultimately lied on their cost base.

What Blue Air’s capacity data shows?

This week’s Cirium Diio Mi data shows a much more down-to-earth network for Blue Air, with exactly 500 flights scheduled for October — last week, it was more than three times this figure.

While November still shows an irrealistic schedule (for five aircraft at least), let’s dive into their October program. The map only shows segments with two or more operations.

Naturally, Blue Air does not want to get away from what worked before — catering to the Romanian diaspora.

Even now, in fact, their network seems overly optimistic, with three aircraft based in Bucharest and one each in Bacău, Iași and Turin; keep in mind Planespotters.net’s database says five aircraft remain in their fleet.

It will be tough from here

Of these five aircraft, two are the very old 737-500s, which naturally are no match to the A321neos and 737 MAX 8200 its competitors may be able to use. It has only 120 seats, versus its competitors’ 239 and 197, respectively. The much higher fuel burn of an airplane two generations older means it will be tough to compete with the other LCCs.

And then, there is the scale problem; Blue Air will restart much smaller than it previously was; if it barely made money with more than ten aircraft, the challenge will be even higher with five.

Finally, its suppliers are now asking for money in advance, as they recognized in a press release a couple of days ago.

«The refund of all sums owed to passengers […] depends essentially of the restart of the operations and of Blue Air’s sale activities and […] another essential factor is a cash injection from one of the two investors with which we are in discussions», the airline added.

Blue Air still hasn’t restarted its sales for the target date of October the 10th and it seems clearer that, if these investors do not appear quick with fresh cash, the last indie LCC in Europe will be gone for good.