The Colombian Civil Aeronautics (Aerocivil) published a preliminary report on passenger movement during the first half of 2023, revealing a significant decline in the domestic market compared to 2022. This decline occurred after the cessation of operations of two airlines such as VIVA and Ultra Air, both of great relevance in the Colombian aviation landscape.

At the end of February 2023, VIVA suspended its operations, generating a crisis of stranded passengers in Colombia and other Latin American and Caribbean countries. Several airlines intervened to rescue these travelers, but the effects of VIVA’s withdrawal were already evident.

Adding further complexity to the situation, Ultra Air also ceased operations on March 30, 2023. With both companies out of service, the repercussions on the Colombian aviation industry were significant.

This raised concerns among government entities, tourism agencies and airline associations such as the Latin American and Caribbean Air Transport Association (ALTA) and the International Air Transport Association (IATA).

The fall of the domestic market in Colombia

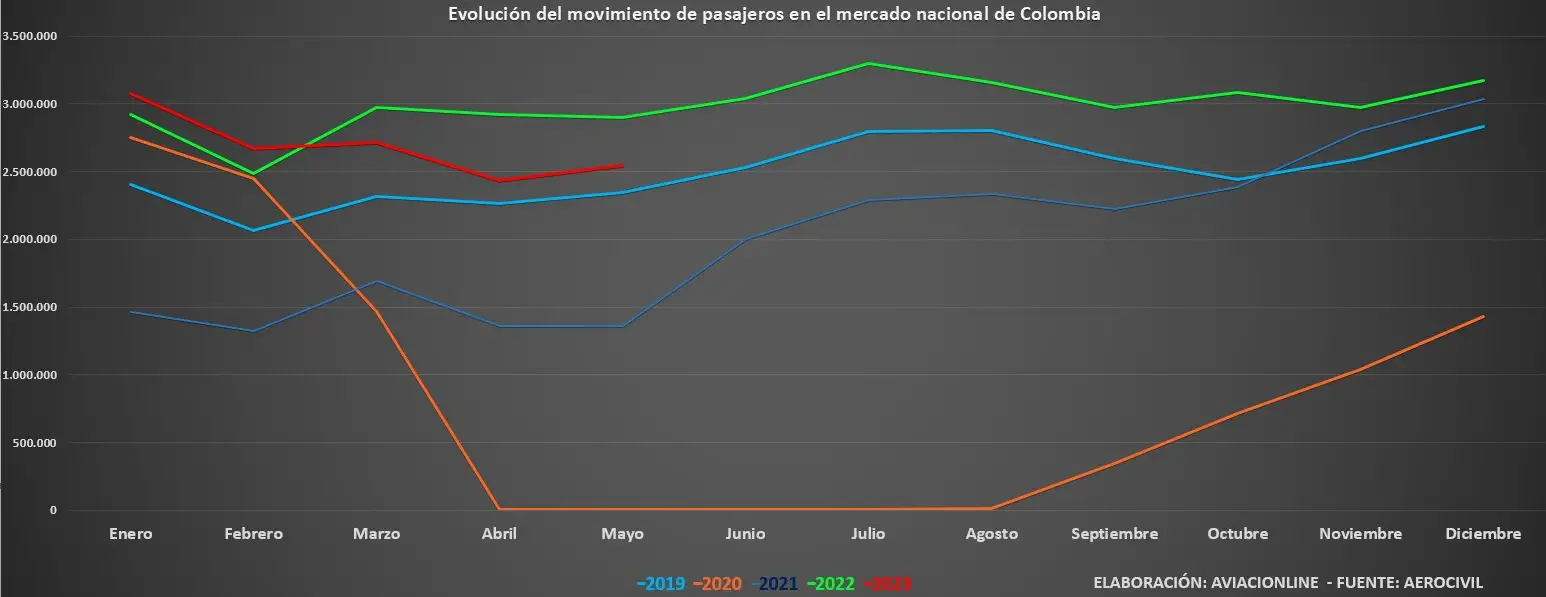

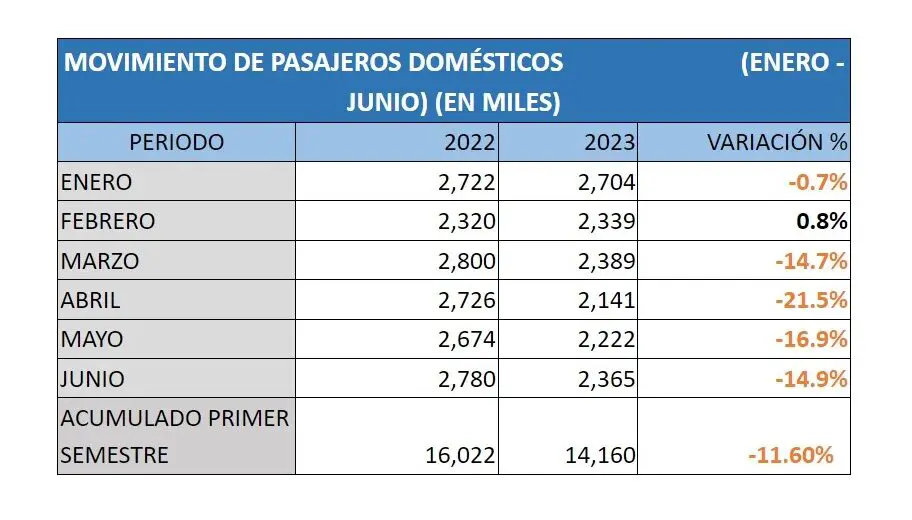

According to Aerocivil’s report, the domestic market experienced a decline of 11.6%, with a movement of 14,160,000 passengers during the first half of 2023, compared to the 16,022,000 passengers recorded during the same period in 2022. Although there was a slight growth of 1.62% compared to pre-pandemic levels in 2019, it was far from the remarkable growth experienced in 2022.

Colombia’s aviation industry performed exceptionally well in 2022, being an example of resilience globally and outperforming pre-pandemic numbers. All airlines, except Avianca, experienced exponential growth during that year, expanding routes and destinations.

However, a number of factors contributed to the affliction of passenger movement in 2023 and both low-cost carriers. The region faced a crisis of inflation and currency fluctuations, combined with post-pandemic organizational challenges. In addition, Russia’s invasion of Ukraine caused fuel prices to rise, affecting local airlines.

The decline of VIVA and Ultra Air

During the last quarter of 2022, VIVA’s problems began to become evident, as it faced delays in the deliveries of its next Airbus A320neo and returned two aircraft. Easyfly also reduced its destinations after announcing a significant expansion in the regional market. Avianca began a reorganization process that included fleet and route cuts.

Although Ultra Air remained operational for a while, it proved unsustainable to maintain constant promotions with fares below US$4. Both VIVA and Ultra Air achieved high occupancy rates through low-cost promotions, but the region’s exchange rate volatility generated concerns among investors.

VIVA attempted to sell the airline to Grupo Avianca, but this move raised antitrust concerns due to the low cost carrier’s position as Colombia’s third largest airline. Ultimately, unable to obtain the necessary resources to continue operations, both Ultra and VIVA were admitted into a liquidation process, using their assets to pay their debts, leading to their eventual demise.

Underserved Market: 3 Million Passengers Drifting Away

The departure of VIVA and Ultra Air resulted in a 15% month-over-month decline in the market, which has yet to be covered by any airline. Despite the efforts of Avianca, Easyfly (now Clic), LATAM and Wingo to increase their offerings and introduce new routes, the demand left by low-cost carriers remains a challenge.

According to Cirium data, during the second quarter of 2023, these airlines have increased seat availability compared to the first quarter.

Wingo, for example, increased its monthly seat supply from 90,000 to 120,000 seats and introduced new flights to several destinations.

LATAM increased its seat availability by adding more Airbus A320ceo aircraft. Avianca, focused on VIVA’s important base in Medellín, increased frequencies and inaugurated new flights connecting San Andrés with Cali and Medellín.

The regional airline Easyfly, now Clic, has added several new links where VIVA used to operate. Among them from Medellín to Pasto, Valledupar and Cartagena; and between Bogotá with Cali and Bucaramanga.

The Colombian government is eagerly awaiting the entry of new operators into the market to help alleviate the crisis in the aviation sector. jetSMART aims to launch its first domestic flights in 2024, with an initial fleet of six Airbus A320s.

The decline of the domestic market has been evident, leaving millions of passengers looking for options. While existing airlines have attempted to fill the void, it remains to be seen how the industry will evolve with the possible entry of new players such as jetSMART. Only time will tell if Colombia’s aviation market can regain its former resilience and growth trajectory.