It has been observed that VIVA’s subsidiary in Peru slowly and quietly began to reduce its domestic operations, reaching only four destinations by the end of 2021.

The Peruvian airline market has been experiencing ups and downs in recent years. From the six airlines operating in 2017, LC Peru (in 2018), Peruvian Airlines (in 2019), and Avianca (in 2020) were disappearing, leaving only LATAM, Star Peru, and Viva. Although along the way SKY Airline Peru was also added in 2019, ATSA and Wayra Peru re-emerged with unprecedented operations, while JetSMART is warming up its engines to disembark.

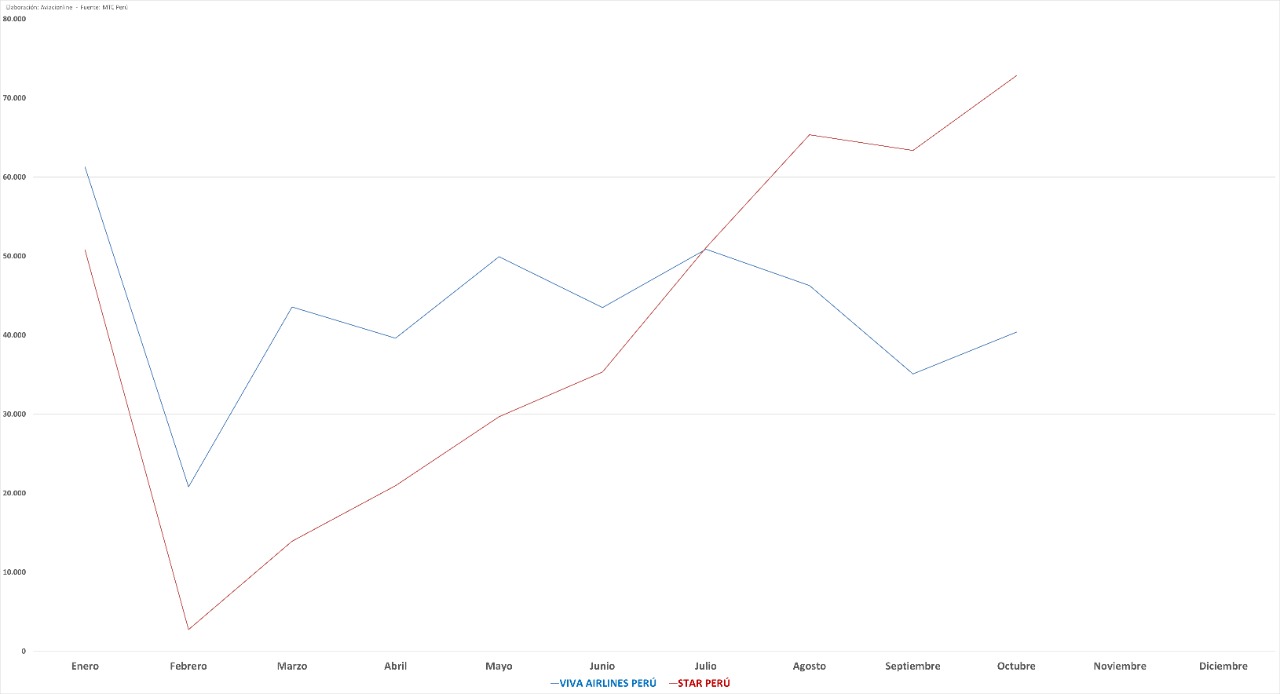

VIVA (Blue) has maintained the same passenger flow, while Star Peru (Red) has been rapidly recovering its passengers, but surprisingly VIVA has been losing market share, with Star Peru taking third place from the ultra-low-cost. The company was operating in January 2020 in twelve cities and by the beginning of 2022, it will operate only four (Cusco, Juliaca, Tarapoto, and Chiclayo). More worrying is that by February it will only operate to the gateway of Machu Picchu.

A complex 2020 for VIVA in Peru

The first sign of problems was the departure of Stephen Rapp as CEO of Viva in Peru in June 2021, who was replaced by Carolina Vigil as new Commercial Manager, which, as stated by the airline at that time, was in response to its strategy of expansion and international growth, and adapting to the changes faced by the airline industry.

When contacted by Aviacionline for this article about the future of its operations in Peru, VIVA stated that it is implementing «some changes in its itineraries for 2022, with the purpose of offering a better connectivity» and «optimizing its operation in accordance with the behavior of the Peruvian market» in what it defines as the continuation of «the execution of its new international growth strategy for the next months».

«This is how the company permanently evaluates its routes to offer the best options to its travelers and, in this way, continue democratizing the skies in Latin America», they concluded.

Viva’s situation in Peru contrasts with that in Colombia, where growth has been exponential and there are better opportunities for further expansion.

The course of the pandemic found Peru swamped with many sanitary restrictions including the suspension of flights on long weekends, PCR testing and affidavits, and the prohibition of travel to certain regions, among others. In addition, the government limited daily operations at Jorge Chavez International Airport to avoid crowds at the terminal as part of anti-COVID protocols.

See also:2022: SKY Airline Peru to reach Colombia and the United States and increase its fleet

This downsizing in the domestic sector has also had its counterpart with the launch of international flights from Bogota (BOG) and Medellin (MDE), offering connections to other destinations in its network, in response to the increase in SKY Peru flights to destinations such as Cancun, Punta Cana, and Buenos Aires.

Peru had several ups and downs

It is not the first time that the country has seen the closure of several airlines at the same time. Between 2005 and 2010 AviaSelva, TANS Peru, the former Wayraperu, Nuevo Continente, and Magenta Air ceased operations. Between 1997 and 1999 it was more egregious when Faucett Peru, Aeroperu, and Americana de Aviación departed, leaving the Andean country almost totally unconnected.

Unlike the current stage, there are two companies that maintain the most important connections. SKY Peru remains firm after having transported 1,016,743 passengers between January and October 2021, LATAM on the other hand transported 4,212,937 travelers in the same period and Star Peru has been the surprise to close the podium by mobilizing 405,985 customers.

See also: ATSA Airlines to fly between Lima and Mazamari

ATSA Airlines has taken protagonism in 2021 by connecting unpublished destinations such as Punta Sal and Mazamari, moving 95,553 passengers. Another airline that maintained good levels of travelers is SAETA, known for connecting the northern region of Peru, which recorded an average of 5,100 travelers per month.

See also: JetSMART Peru receives approval for its creation: analysis of awarded routes and domestic market

The arrival of JetSMART Peru, which obtained its air operator’s certificate last week, may fill the totally inexistent segment of connections between secondary cities, a model with which it excelled in Chile and Argentina.

These developments are taking place while political sectors continue to promote the creation of a state-owned airline, which would be nonsense both in terms of taxation and connectivity in a market that has been able to recover every time it has faced different hurdles.