Analysis: in Norway, Flyr’s problems go beyond their network

Here’s a fact that you wouldn’t have believed two or three years ago; of Norway’s three large airlines, Norwegian Air Shuttle is the only one that is not in immediate trouble.

While Norwegian Air Shuttle found a way out off the mess they were in, SAS entered the Chapter 11 bankruptcy protection, starting to renegotiate its debt serving and its liabilities.

And guess what; with this, the airline that pledged to reap the leftovers from the other two, Flyr, is the one in big trouble.

https://www.facebook.com/FlyrNorway/photos/a.201517515113380/540315507900244/

Their network for Winter will thus be reduce to a fraction of what it would be. According to a press release, the measures will allow Flyr to save up to NOK400 million (USD37.62 million) in cash burn (as of October 16, 2022, NOK1=USD0.094).

Flyr was clear in saying that it «put non-profitable routes on hold» or the season. The European aviation market tends to be more cyclical from Summer to Winter than most regions.

According to Routes Online, among the destinations slashed were Athens, Faro, Pisa and Porto, but there are more routes being slashed, if we take Flyr’s routemap before the cut (left) and the current map for Winter season (right). Milan and Salzburg will only be started in February 2023.

Assuming that the routes that remain are actually profitable, one might want to look into the routes that are left — and if Flyr will manage to survive this Winter season.

Flyr’s remaining Winter routes

To start off, Flyr is in a very delicate position in that it will face competition in all routes that are left. And in most of these routes, apart from Oslo-Brussels, it sees Norwegian Air Shuttle as a direct competitor.

Now Norwegian has left the pandemic in a fantastic position; it may not deliver Europe’s lowest cost (after all, it is based in the Nordics), but it is well capitalized and its overall debt is low; it has really emerged from COVID as the major driver of low-cost travel in Scandinavia, and most importantly, it has stopped burning cash in this Summer season.

Flyr was born with the intention to benefit of the highly-demanded domestic market in Norway, having in mind that it wanted to be smaller, but profitable, according to its business plan filing.

In fact, it did not plan to further raise cash, for it had a low cash burn expansion strategy; it planned to end 2022 with 19 aircraft and over 100 daily flights in Winter.

That would be because «several of the Company’s competitors rely on constantly growing fleet size, network and passenger figures», said the prospect, «while Flyr will aim to adapt and optimize scale and production to demand with a business model that is profitable on a lower scale of operation. The Company believes that this business model ensures it to be a highly competitive LCC company.»

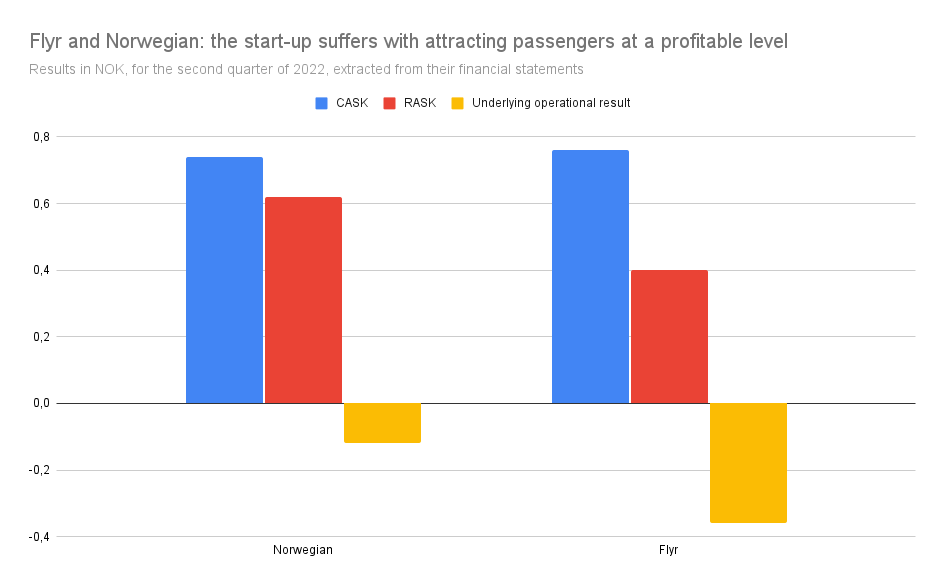

And indeed, Flyr did reach a competitive unit cost with a small fleet. In the second quarter of the year, according to both companies’ financial results, Flyr produced a CASK (operating cost per ASK flown) of NOK0.76, while Norwegian’s was at NOK0.74.

Flyr currently has a fleet, according to Planespotters.net, of six Boeing 737-800 and six 737 MAX 8, all based in Oslo. Meanwhile, Norwegian’s is composed of 67 737-800 and two 737 MAX 8, based in Bergen, Oslo, Stavanger and Trondheim (Norway), Copenhagen (Denmark), Helsinki (Finland) and Stockholm (Sweden).

However, the airline says that the personnel maintained after the reductions will be enough to operate five or six aircraft only.

While its fleet (half of which is next-generation airplanes) has generated a reasonable unit cost after its ramp-up, the true problem that lies in Flyr’s financials is clearly one; not attracting enough passengers and, more importantly, not having passengers pay enough to cover their costs.

The result is the one you see below. In the second quarter, for one ASK flown (seats offered multiplied by the flight length), Norwegian managed to make a revenue of NOK 0.6, while Flyr’s was at mere NOK0.4.

Things, it seems, did not get much better in peak Summer season; Flyr’s traffic reports show a RASK of NOK0.68 in July, NOK0.42 on August and NOK0.45 in September. Meanwhile, Norwegian’s were, respectively, at NOK0.95, NOK0.68 and NOK0.68 again.

That would mean that, if the costs remained constant, that would be enough to reduce the cash draining; but it would not enough to turn the tide towards profits, even during Summer.

Remember: air travel in Europe is very seasonal — more than in most places — and this means that, if an airline cannot make money in Summer, Winter will hardly bring any miracles.

“We have experienced satisfactory demand on our routes to European holiday destinations», said CEO Tonje W. Frislid in the press release annoucing the cuts. «At the same time, we must admit that it has taken longer than expected to build loyalty among business travellers on domestic routes in Norway, where the incumbent carriers maintain large market shares.»

But Flyr’s troubles don’t end here

Flyr raised cash twice in the markets after its IPO, with each offer lower than the initial price of the share — hinting at a decreased hope from the markets in that the airline will be successful.

Still, the airline said in the press release that it «engaged the financial advisors Arctic Securities AS, Carnegie AS and Sparebank 1 Markets to conduct meetings with both existing and potential new investors». It added that «The purpose of these meetings is to discuss potential financial instruments to strengthen the Company’s financial position.»

While the company’s share floated at the Oslo Stock Exchange for NOK5 back in March 2021, the current price for one stock of the airline is worth NOK0.3.

One of the most vocal critics of Flyr’s project, Norwegian analyst Ole Martin Westgaard, from DNB — the country’s largest bank — remarked to website DNB Markets that «the more they fly, the more they lose. Flyr’s survival depends on investors finding it fun to be part of this loss-making project.»

Westgaard echoed his doubts about the airline’s future in a recent interview to Finansavisen, a local business newspaper, after Flyr’s Winter cuts made to the media.

«We believe the company has already knocked on most doors [for more funding]», he said, «and that a lack of interest resulted in Tuesday’s announcement. Now it’s about turning over every stone to prevent bankruptcy.»

He told the website that shifting to Europe from the harsh domestic market — from which even the very aggressive low-cost carrier Wizz Air dropped out in 2021 — may be a sensible solution to halt the losses.

«They have not managed to differentiate their offer and in a competition on price they have too high costs compared to Norwegian», said the analyst.

And crucially, this is the problem for Flyr. They are just not different enough from Norwegian to find themselves a place in Norway. Had Norwegian been liquidated, the story would be completely different, but as of now, the situation for Flyr looks very concerning.

Asked by Aviacionline if the restructuring of Norwegian (and SAS) had played against their favor, Flyr’s Vice-President of Communications, Anita Svanes, said, via email, that «Flyr was established to be a low-cost carrier (LCC) with a demand driven and sustainable business model, with focus on serving the Norwegian market with domestic and international flights from its base at Oslo Airport.»

«Flyr’s mission», she added, is «to create something new in a very traditional industry, the Nordic model with employees in Norway and Norwegian conditions, taking customer experience to new heights.»

And as for additional funding, the executive confirmed that «we have a good dialogue with financial advisors, which confirms good interest in us from both existing and new investors. Any measures to further strengthen operations and balance sheets will be discussed at a later date».

/https://aviacionlinecdn.eleco.com.ar/media/2022/10/ae7ef10dc27f665c_org-scaled.jpg)

Para comentar, debés estar registradoPor favor, iniciá sesión