The largest intra-Europe airline, Dublin-based Ryanair has long seen Central and Eastern Europe (CEE) as a pool of opportunities for its growth.

Over the 2000s and 2010s, with macroeconomic stability and more states joining the European Union (and the labour integration that comes with it), demand for travel across the continent grew consistently.

That’s the case of Romania. Even before joining the EU, the country’s demand for air travel seemed endless; the growth figures were huge back then, and still are today. While Ryanair took part (to some extent) in this growth it still lags behind Wizz Air, especially when comparing it to other major Eastern countries.

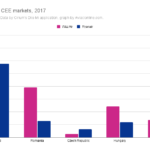

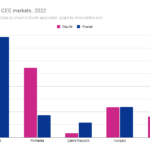

For instance, take the five largest Central and Eastern Europe countries — respectively, Poland, Romania, the Czech Republic, Hungary and Bulgaria.

(All capacity data was gathered with Cirium’s Diio Mi application)

While Ryanair has widened the gap to Wizz Air in Poland and in the Czech Republic, it overtook Wizz in their home turf of Hungary and closed the gap in Bulgaria, the Romanian market remains the one where Ryanair is yet to get close to its Hungarian competitor.

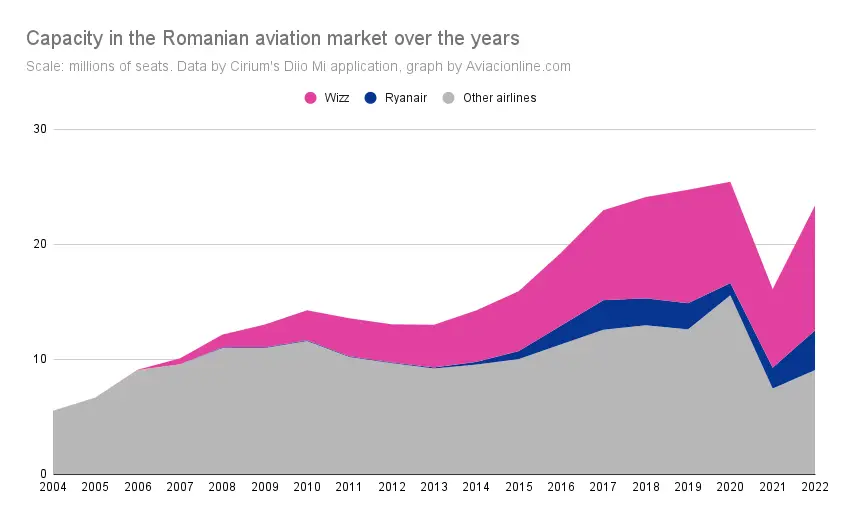

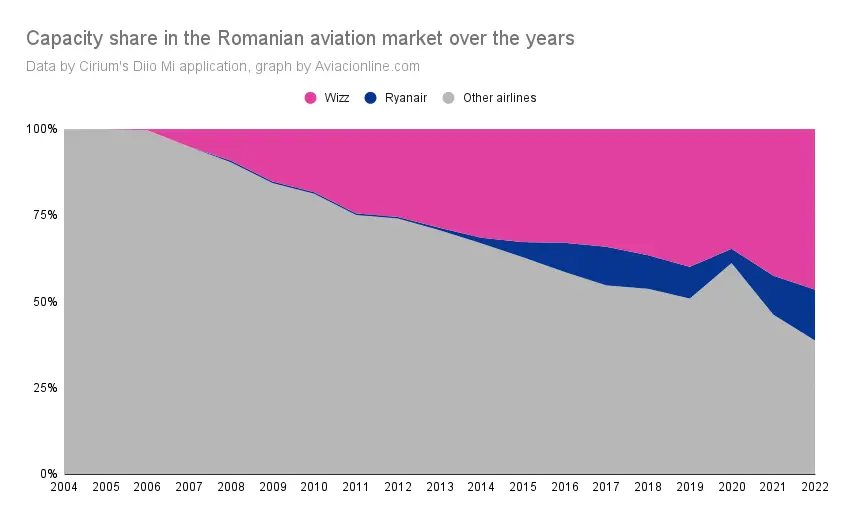

If we break down the capacity per airline from and to Romania, Cirium’s Diio Mi application provides us an interesting overview of the market situation, and how both Ryanair and Wizz have taken over the market there — even if Ryanair is miles behind Wizz, still.

Or better yet, in a share perspective: combined, the two largest European low-cost carriers (LCCs) hold more than half of the capacity to and from Romania.

In terms of operational bases (airports where the airline has local crews and stationed aircraft), Romania remained lagging in terms of cities added — compare it to Poland, the largest market in Central and Eastern Europe, for example; Romania, the second-largest population of CEE, remains with a single base, in Bucharest’s Otopeni airport.

Still, this past week Ryanair has announced two new destinations in the country — the two largest cities that were still not served by the airline: Cluj-Napoca, the largest town in the historical region of Transylvania, and Iași, the largest one in the historical Moldavia.

Cluj, in fact, had already started receiving flights, on a relative short notice, from Dublin and London/Stansted, after the demise of Blue Air earlier this year.

Where Ryanair is pointing to from Cluj and Iași

The two cities, in Summer 2023, will count with nonstop connections to Brussels/Charleroi, Dublin, Milan/Bergamo and Paris/Beauvais.

Which means that Ryanair took the obvious (or would it be the cautious) way when picking the routes. According to Cirium, Ryanair’s top 5 airports this quarter are, respectively, Stansted, Dublin, Bergamo, Barcelona and Charleroi.

But Barcelona is highly slot-constrained, which means Ryanair cannot organically grow there any further. In Eddie Wilson’s, Ryanair DAC’s CEO, own words in an Irish Oireachtas hearing some weeks ago:

IWe can then assume that Ryanair took both the obvious, the easy and the cautious way when picking their routes from Cluj and Iași.

Essentially, this means that Ryanair can add capacity to these two cities without commiting an aircraft to be based in any of those airports, which reduces risk and, if any of those routes does not succeed, they can easily be dropped after the Summer season is over.

However, one might ask, Ryanair is known for its aggressive approach. Considering that a major player in the Romanian market (Blue Air) has just gone bust, shouldn’t they have gone with more «appettite», so to speak, to these markets?

We would say there are two reasons behind this.

Wizz and its A321neos

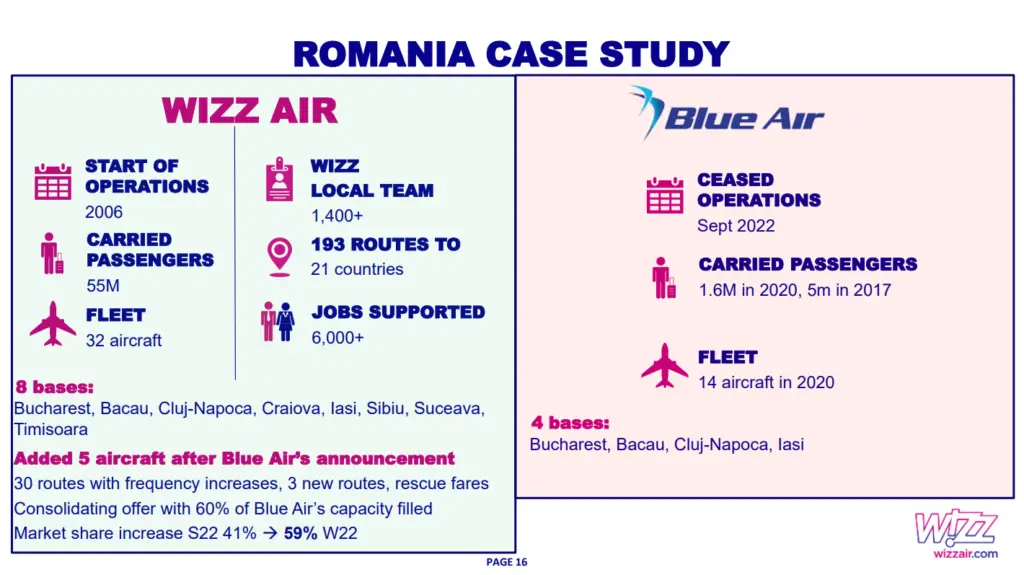

Enter Wizz Air. The Hungarian LCC is miles ahead of anyone else in the Romanian market. They have bases in Bacău (one plane), Bucharest (17), Cluj (seven), Craiova (two), Sibiu (one), Suceava (two) and Timișoara (two).

In other words, they are the leading player there, with a quarter of their fleet based in the country, and as their latest investors report showed, with a full slide dedicated to the post-Blue Air scenario, they have no intention of dropping the ball there.

According to the slide, shown below, they have added five new aircraft there since Blue Air went bust, and as per their own measures, they ate 60% of the late airline’s capacity.

When you compare this huge structure to Ryanair’s two-aircraft base in Bucharest, you can tell who has the better hand here.

Yes, according to what we said some months ago, Ryanair can produce a better unit cost (and we absolutely stand by that), but it’s an uphill challenge in Romania — more so than it is in any other market now.

Another argument in favour of the theory that Ryanair has the better tools to fight Wizz Air is their own base in Bucharest/Otopeni. Yes, they might be the small ones there (two aircraft versus 17), but they base the old 737NGs there — not the MAX, which can produce an even lower unit cost.

This may, albeit indirectly, show that they don’t need to focus their best assets in Bucharest in order to have a profitable operation there — even though Wizz Air has the upper hand and an absolute dominance.

In time: all Wizz Air aircraft based in Bucharest as of this week are A321neos, which in theory produce the best unit cost in Wizz’s fleet.

That’s despite the fact that that this aircraft composes only 43.6% of the airline’s fleet (75 of the airline’s 172 aircraft), according to data by Planespotters.net, and that Bucharest’s 17 based aircraft represent only 10% of Wizz’s entire fleet.

Well, it might just be all a big coincidence, but still. If it is, that is a big coincidence. But if it’s not, it may well show that Wizz is prepared to put up a fight for its Romanian market. And to do so, it is deploying its very best assets there, producing the lowest unit cost while at the same time flooding the market with capacity — their A321neos all have 239 seats, while Ryanair’s largest aircraft, the 737 MAX 8200, has 197.

Ryanair’s MAXes

Speaking of best assets, let’s get back to Ryanair, and back to their 737 MAX 8200, which they’ve been calling the «Gamechangers» for the last two years.

There is this eternal fight between Ryanair and Boeing. While the Irish carrier has shamelessly benefitted from Boeing’s discounts (and thus low ownership costs) as a cornerstone of its success, the MAX program, as we well know, has been plagued with issues.

After the MAX got back flying, Ryanair has been constantly complaining about delivery delays and whatnot. Currently, according to data by Planespotters.net, they are operating 83 units of the type, out of a total order for 210.

As late as last month, Ryanair’s boss Michael O’Leary had been complaining about alleged delays in deliveries in an Eurocontrol interview.

«We’re contracted to get 51 aircraft from Boeing at the end of April [2023]», said the Irish executive. «We will be lucky to get 40 aircraft by the end of June next year, and that’s critical to our continuing growth next year.»

In essence, Ryanair’s MAX aircraft (despite what O’Leary says) are being delivered at a faster rate than the older NGs are leaving. Their purpose is not to replace the NGs, but rather boost the airline’s growth; this appetite even extended to the company considering to bring used NGs when the opportunity arises, they said in their last earnings Q&A.

However, the more Boeing delays delivery of further MAX 8200s, the more pressured Ryanair will be to focus the deliveries there are in their already-consolidated markets, as O’Leary said in the Eurocontrol talk.

«You know, Italy is still short [of] capacity because of Alitalia’s contraction — we need to put more aircraft into Italy; Spain is still short of capacity because Norwegian’s kinda collapsed out of the Spanish market», said O’Leary. «So there’s many more of those markets that we need to put more of these aircraft into, and it’s vital that Boeing builds the aircraft that it’s contracted to build now».

In other words, if Ryanair is short of capacity due to these delays, Romania will be put in the background, as the airline focus the «little» growth it has into its major markets.

Now this doesn’t mean that Romania will see no growth whatsoever; it could, but chances are that most of it would be largely driven by these larger Ryanair markets — which is exactly what we are seeing in Cluj and Iași.

Naturally, too, new bases or new based aircraft in Romania cannot be ruled out — but as long as their growth is constrained, is nothing that will make Ryanair even get close to Wizz Air in the short- to medium-term.

Two cities are in, four others are out

This week, it also came to light that Ryanair will be dropping out of the four other cities it served in Romania, apart from Bucharest and the two new destinations: Oradea, Sibiu, Suceava and Timișoara.

The news was broken by BoardingPass.ro, the country’s major aviation website. The airline, answering to questions by the website, said that such a decision was taken because of «the lack of incentive options» in those airports.

Ryanair’s business model is also driven by tough negotiating with its airport partners, which means they can easily leave their operations from any airport if things do not go their way.

BoardingPass.ro reports that this was especially true in Oradea and Sibiu — and that their multi-year incentive agreements will not be renewed.

Will these airports lose much? The only one that loses practically everything is Oradea; the only regular service remaining will be TAROM’s three daily runs to Bucharest. Sibiu also loses an important chunk of its operations to plenty of Ryanair bases across Europe, but it will continue seeing service by Austrian Airlines, Lufthansa and Wizz Air.

As for Suceava and especially Timișoara, the airports will not miss much, as Wizz Air has important operations in both cities.

But these movements by Ryanair send a clear message to the airports across Romania — that the terminals that offer the more discounts to the Irish carrier will get the most of what the airline has to offer.

As for the cities that lost Ryanair services, there are, naturally, complaints in the local media. Sibiu’s Turnul Sfatului quoted the airport’s General Manager, Marius-Ioan Gîrdea, who said that ”an even lower level of applicable discounts is not justified”.

While this is one of the most controversial aspect of Ryanair’s approach to business, but one that has been very successful over the years.

What Ryanair says about this

Asked via email by Aviacionline, a Ryanair spokesperson said that «Ryanair has grown 50% in the Romanian market since pre-Covid and we plan to continue growing in this market over the coming years, subject to competitive airport costs.»

«Additionally, we have increased capacity on key routes such as Dublin to Cluj – which were previously operated by Blue Air – so any suggestion that we are being cautious is untrue.»

About the placing of the 737 MAXes, «Ryanair places Boeing 737-8200 ‘Gamechanger’ aircraft at EU airports that are actively working hard to remain competitive and keep access costs down.»

It added that «Bucharest on the other hand is proposing to increase their costs by [approximately] 20% in 2023 which is ridiculous, particularly when other EU airports are actively lowering their charges to recover traffic and grow.»

And over our question about airports across Romania «fearing» to anger incumbent carrier Wizz Air because of negotiating with their biggest competitor, the spokesperson stated that «while we do not believe there to be any ‘fear’ when negotiating with airports, there are some Romanian Airports that have a certain apathy towards other airlines entering or growing at their airports».