REPORT: COVID-19 commercial aviation market impact in Argentina

Data presented in this article is extracted from Argentina’s Civil Aviation Administration (ANAC) official statistics. It’s been processed and interpreted by Avacionline.

Flights

Since ANAC only manages data about commercial flights, this topic only contains about them. Military flights are exempt from it.

We must note as well that private and charter flights will be excluded from analysis because, since their traffic volume is so small, they have a negligible impact on overall statistics.

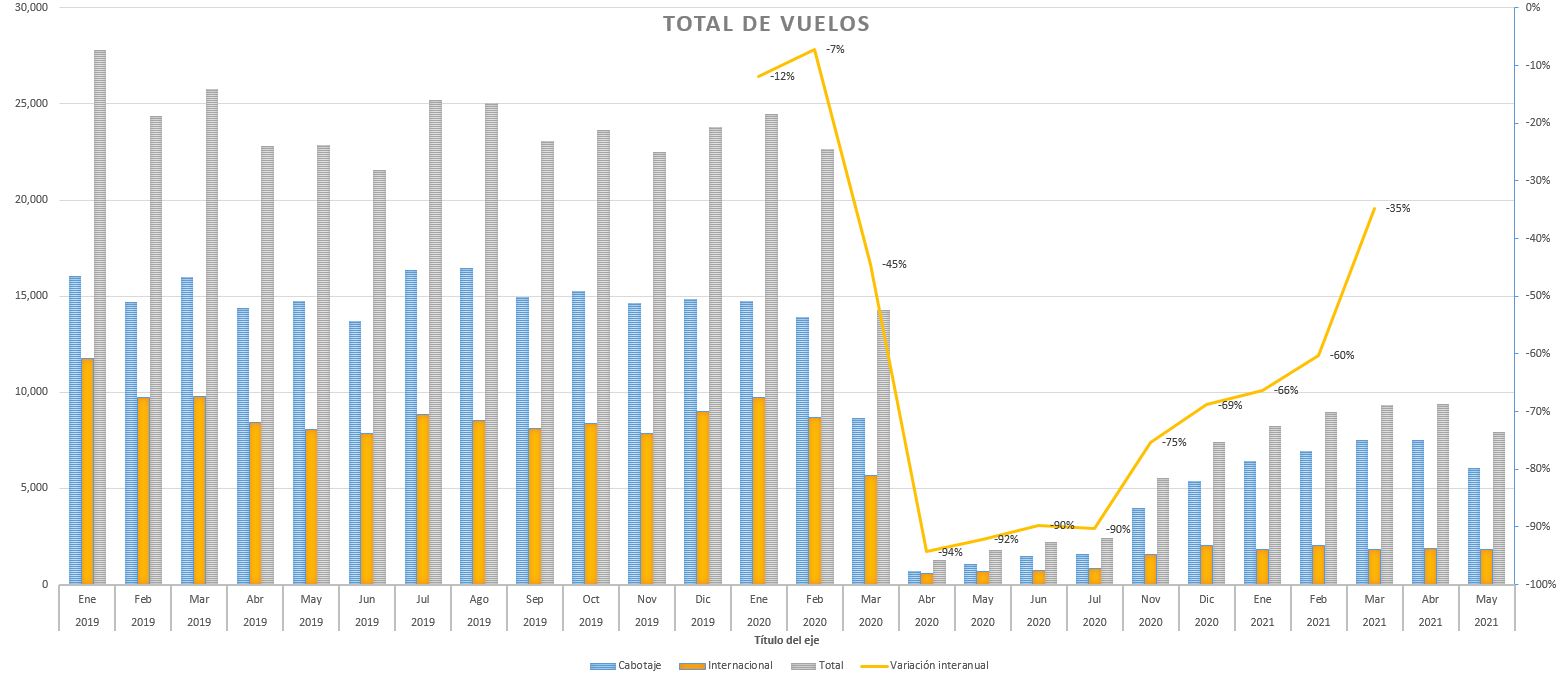

Total flights

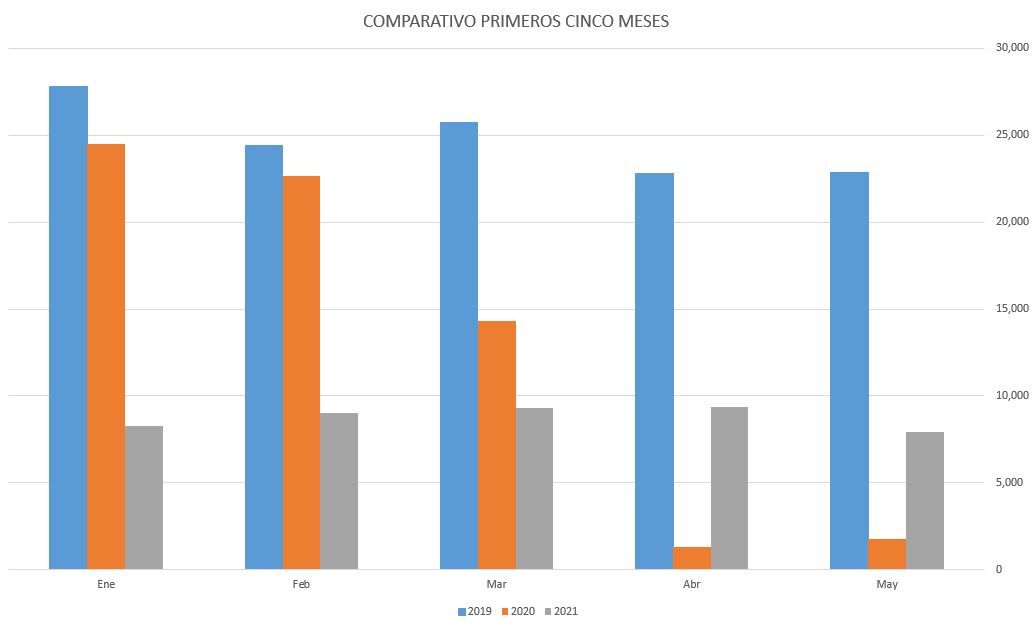

Between January and May 2020 Argentina saw a total of 64,512 commercial operations take place. In the same period of 2021, 43,884 flights took to the skies. This represents a 32% drop.

2019 ended with 75,894 total commercial aircraft flights, a record-setting number.

We can see from the data that March 2021 nearly matched March 2020 in total number of flights. This is, however, a statistical anomaly. March 20, 2020 was the day that an executive order was enforced country-wide, effectively grounding commercial operations in Argentina. This was done in order to prevent the spread of COVID-19. Scheduled flights didn’t return for almost half a year. We can note, however, that the traffic level plummeted when compared to 2019.

Flights in Argentina’s top airports

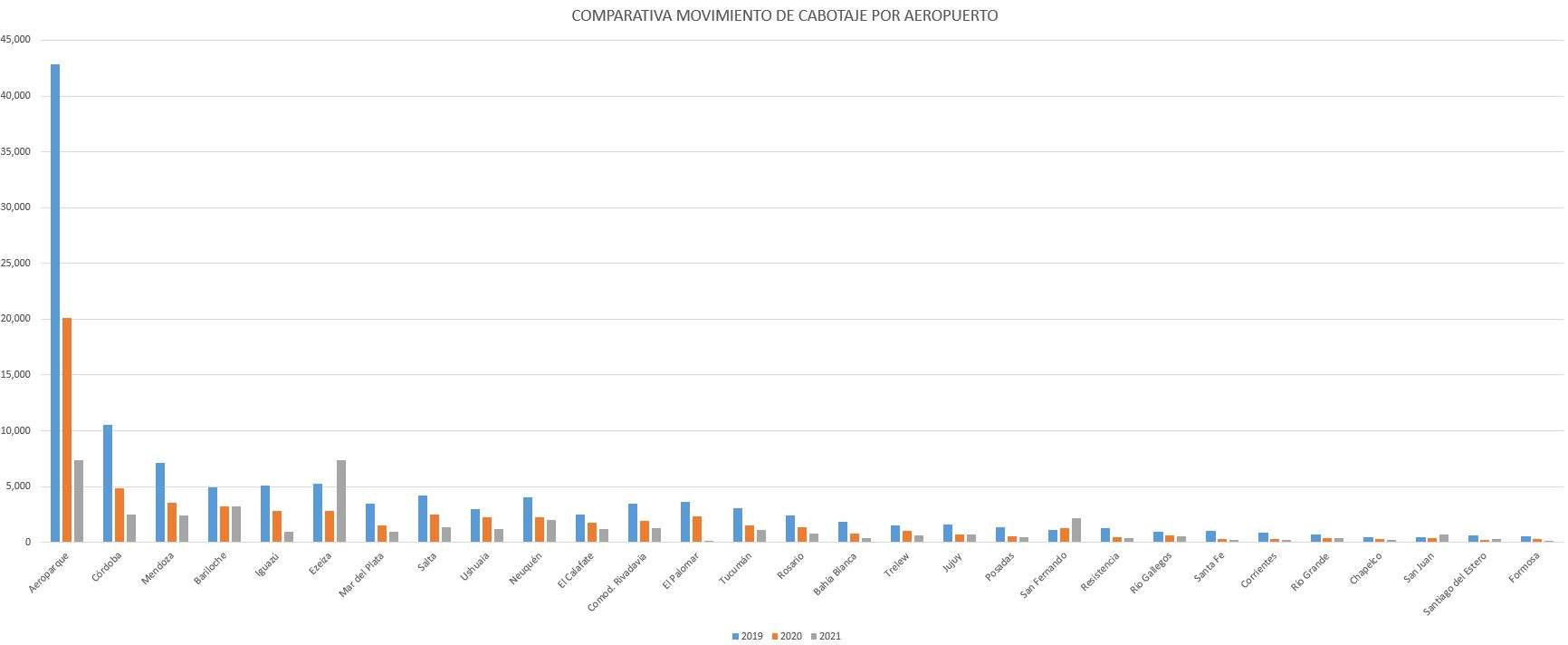

The first chart shows only domestic flights. Data includes yearly number of commercial flights. We can clearly extract from it a major downwards trend, with 2021 flights in most airports reaching about 20% of 2019’s operations.

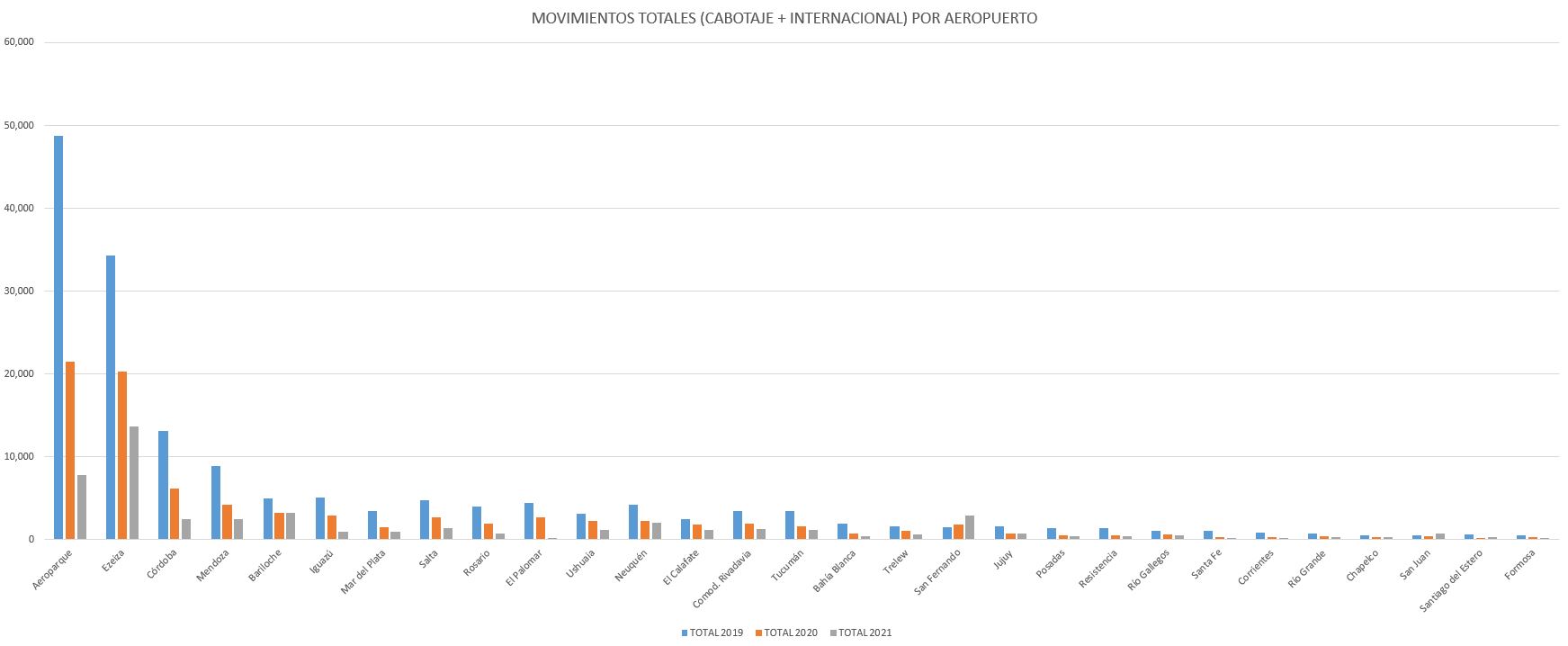

International flights in Argentina are exclusively operated from Ministro Pistarini International Airport (better know as Ezeiza). This is due to a joint resolution between the Public Health Ministery and aviation authorities, in an effort to better track passenger traffic to try and stop the spread of COVID-19 variants. Because of this, international traffic to other airports is not analyzed by itself. However, it’s still counted in the total number of flights chart.

It’s important to note that Aeroparque Jorge Newbery, the busiest airport in Argentina, reopened in March 2021 (Spanish) after a major overhaul of its runway and facilities.

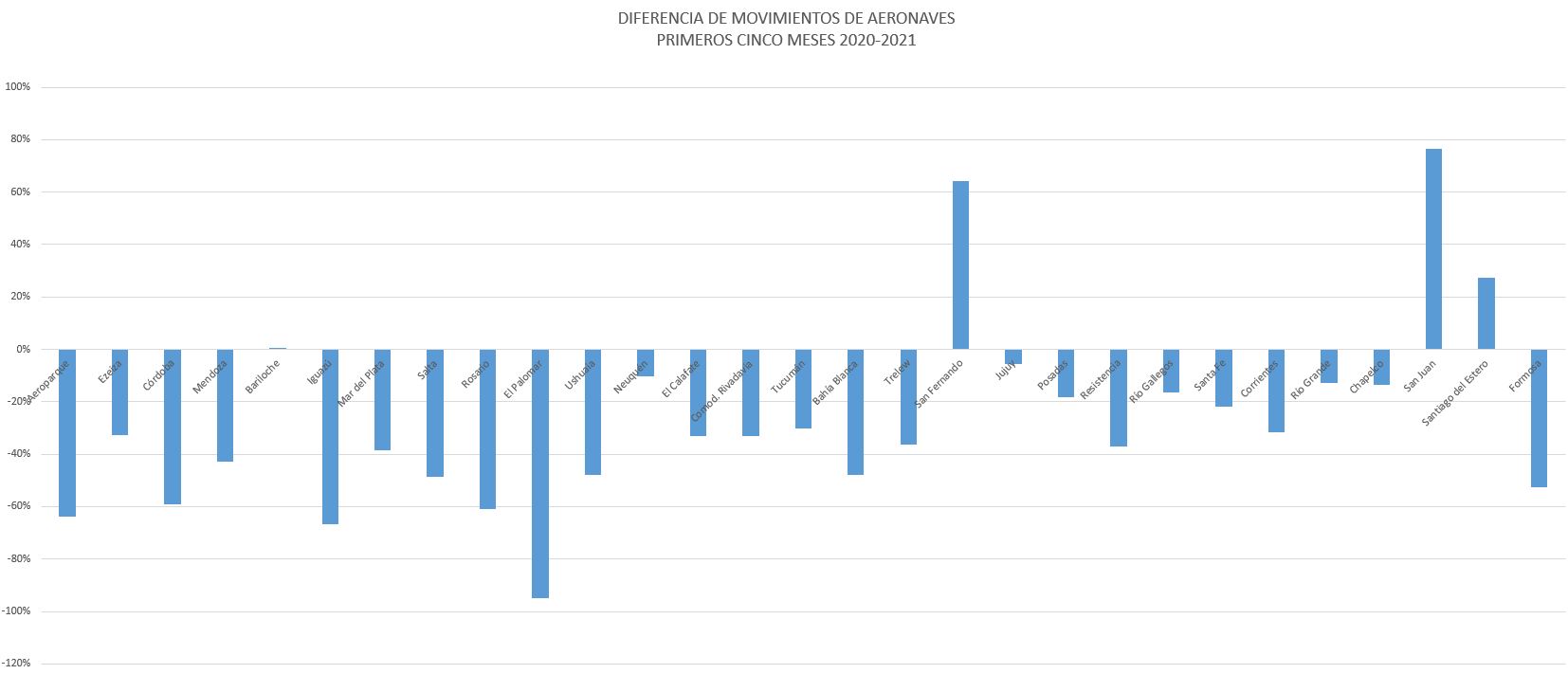

From the next chart, we can extract information about airports that suffered the most severe blow in traffic numbers. Iguazú Airport (the airport that serves Puerto Iguazú, home to the Iguazú Falls) saw a drop of 67% in traffic. Rosario (61%) and Córdoba (59%) follow it and complete the podium.

Strikingly, Santiago del Estero (up 27%), San Fernando (64%) and San Juan (77%) saw an increase in traffic.

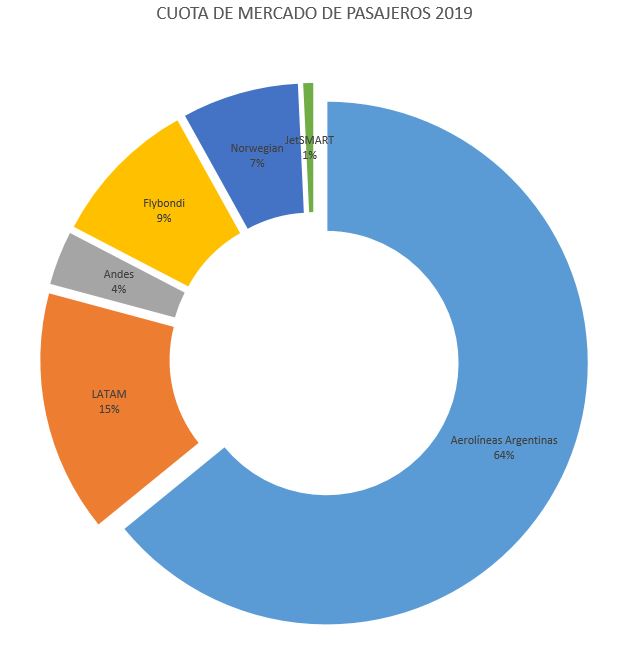

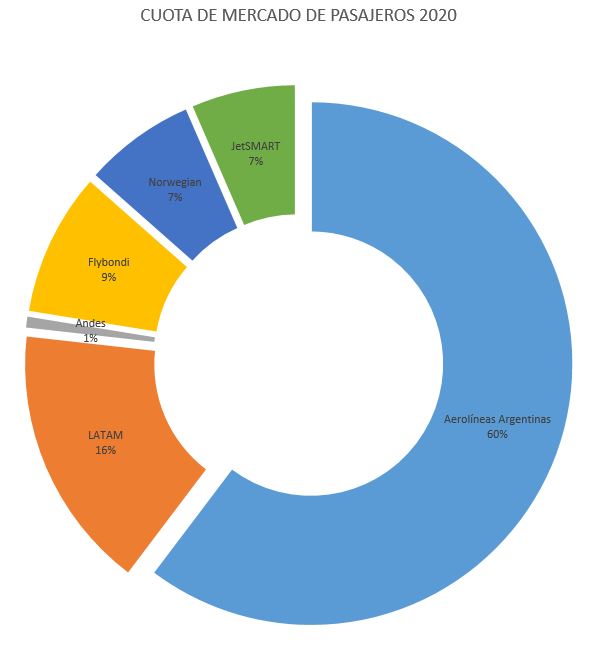

Traffic quota

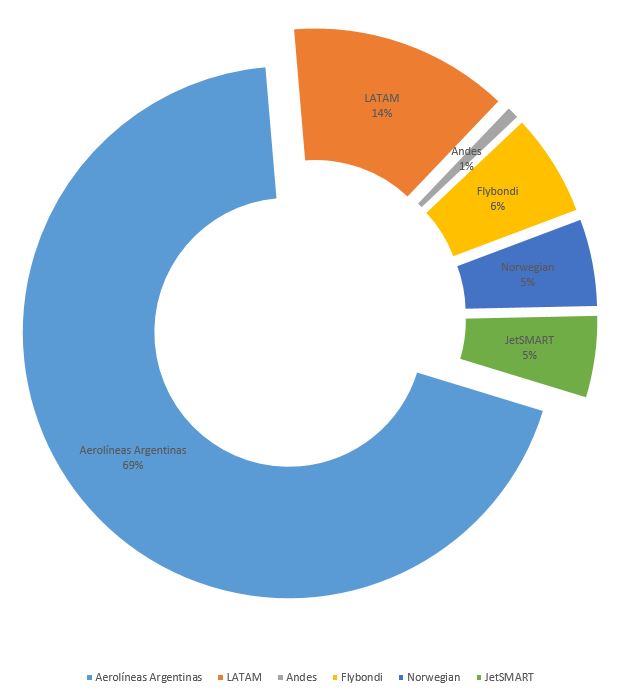

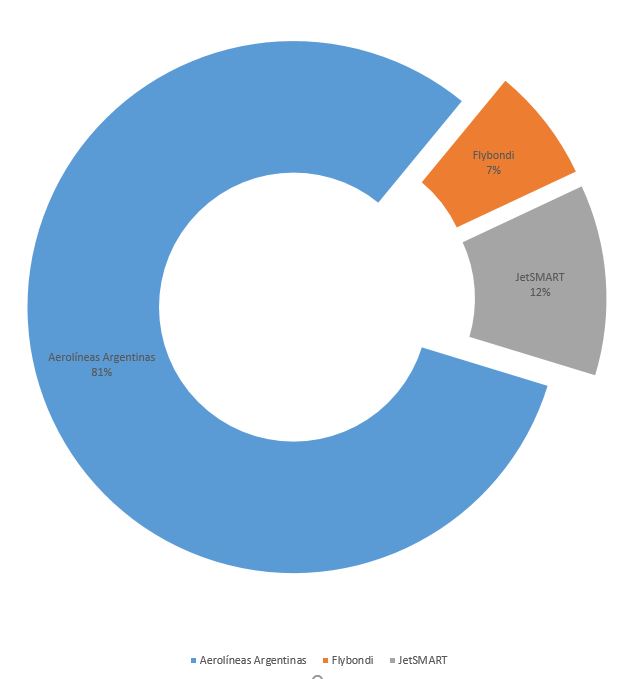

Next, we’ll take a look at the traffic quota between Argentina’s top companies. Here, we can see consolidation in traffic volumes between fewer players.

Both LATAM Argentina and Norwegian Argentina ceased operations. The first one did so in the middle of 2020, after years of economic struggles. Norwegian, on the other hand, abandoned its commercial flights in December 2019 after being purchased by Jetsmart, a Chilean conglomerate. Andes, an Argentinian company based in Salta, has not flown in over a year and a half, and its future hangs on a tightrope.

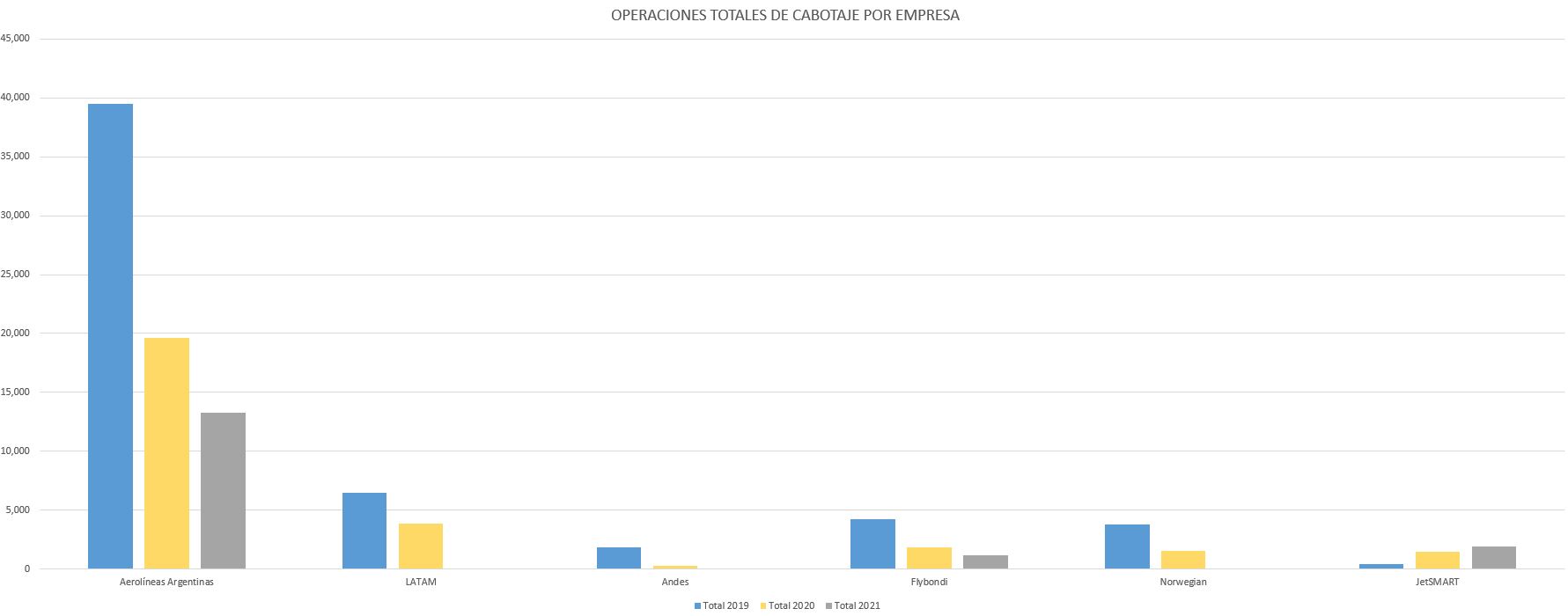

This last chart clearly shows how traffic has absolutely plummeted in Argentina. It must be remarked that Jetsmart Argentina only started flying in April 2019, so the chart will be skewed in its favor.

Passenger traffic

Total passenger traffic

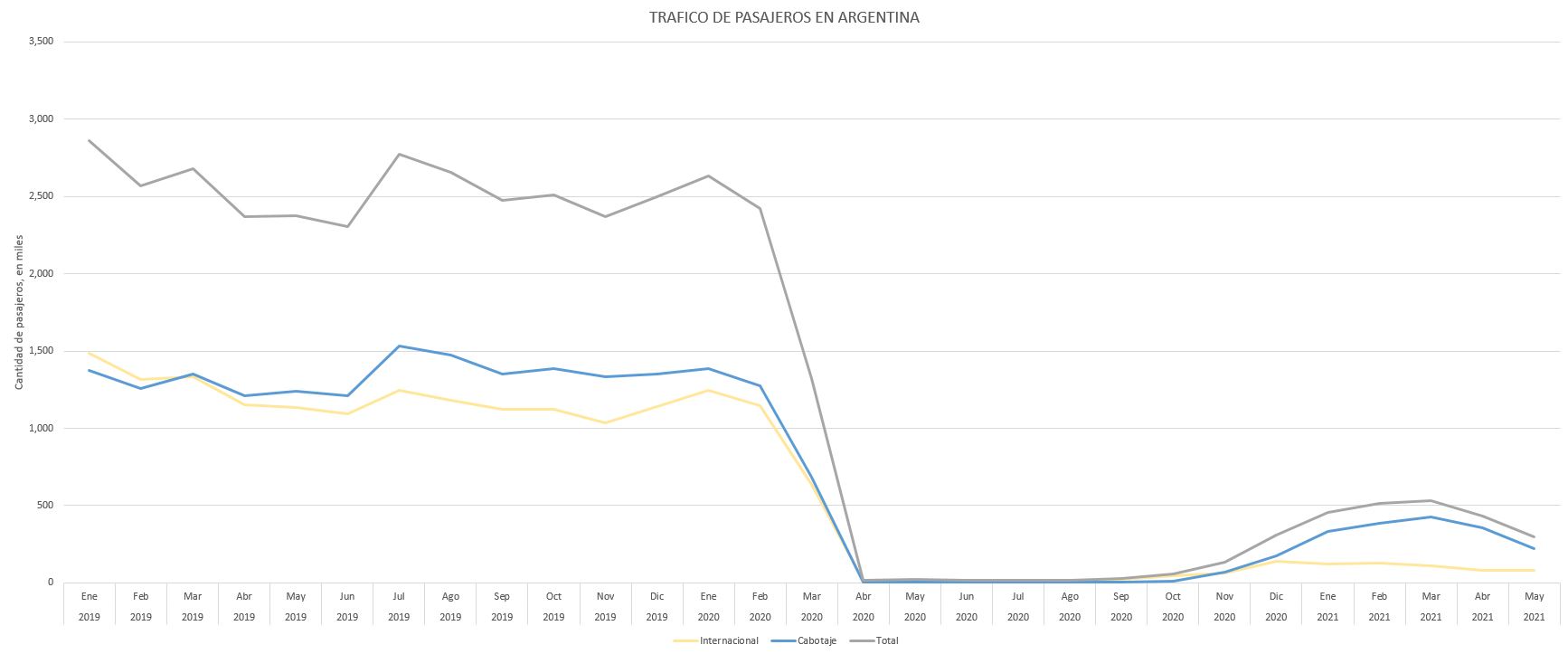

The first five months of record-breaking 2019 witnessed a total of 12,859,369 passengers fly in Argentina. This can be further divided between 6,436,086 passengers flying in domestic operations and 6,423,283 doing so in international ones.

In the same period of 2020, meanwhile, 6,421,781 passengers flew in Argentina. In total, there were 3,353,322 domestic passengers and 3,068,459 international ones. We can see in this number the impact of Executive Order 297/2020, the one that established, on March 20, a country-wide lockdown in order to stop the spread of COVID-19.

Finally, 2021 saw a total of 2,233,755 people traveling by air in the country. 517,667 of them were international travelers, and the remaining 1,716,088 did so in domestic flights.

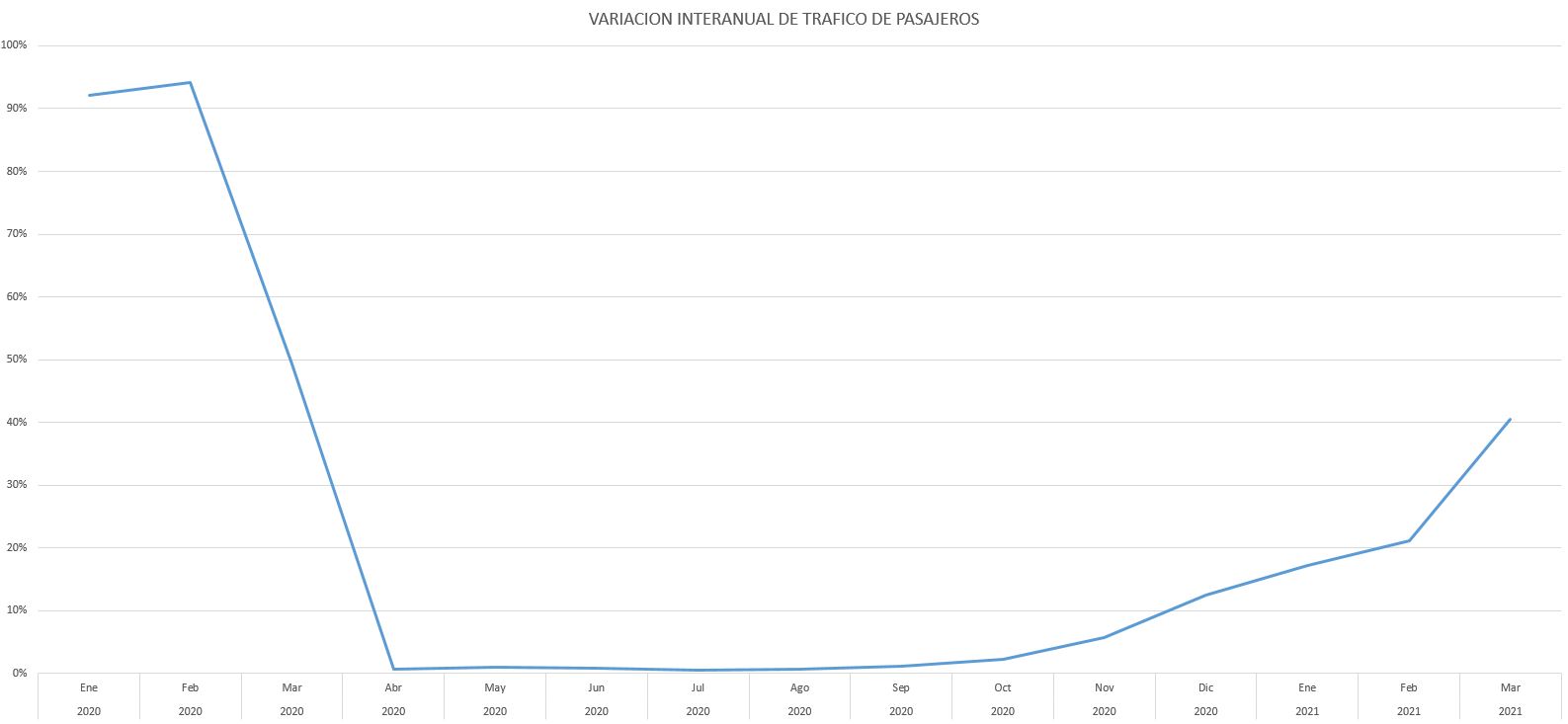

This graph clearly shows how passenger traffic fell since the start of the COVID-19 pandemic. In March 2021 it fell nearly 80% in relation to the same month of 2019.

Year over year levels, meanwhile, are shown in the next chart. We can see here that during the holiday season of 2021 passenger traffic was on the rise, approaching 40% of the level of 2020. It must be noted, however, that from March 2020 onwards commercial flights in Argentina were almost nonexistent (April 2020, for example, saw a total of 18,000 passengers travel, while in May 25,000 people did so).

That rise stopped, however, in April 2021, when Argentina entered the second wave of the pandemic and new restrictions were put in place to stop the spread of the virus.

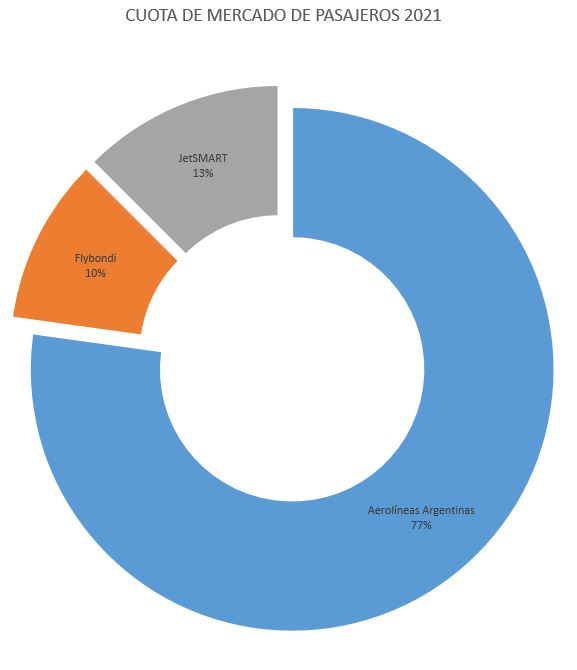

Passenger traffic market quota

Aerolíneas Argentinas, the largest commercial operator in the country, transported in the first five months of 2021 1,300,000 passengers. This accounts for 77% of total traffic in the country. Second came Jetsmart, mobilizing 13% of the total volume (210,600 people). Last is Flybondi, Argentina’s first low-cost carrier, with a total of 173,500 passengers flown (10% of the total).

Tráfico segmentado por aeropuerto

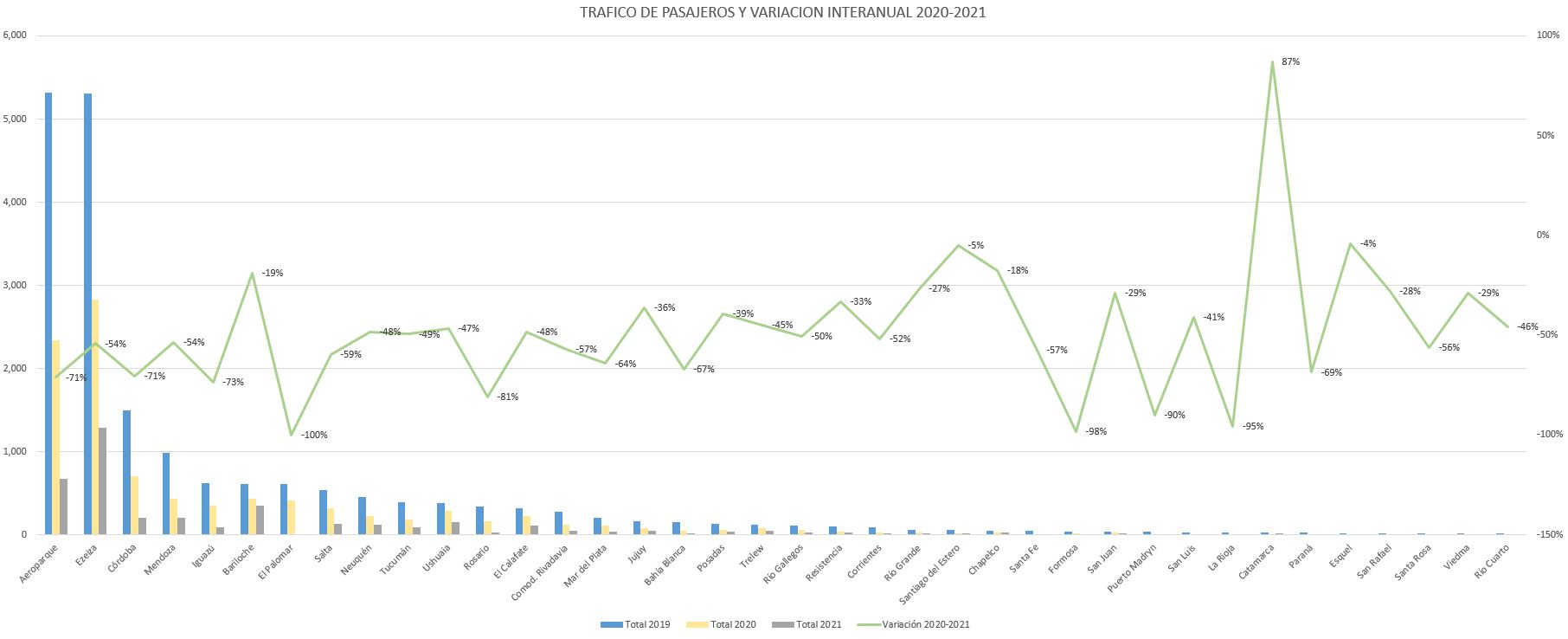

Lastly, we’ll take a look at passenger traffic traversing Argentina’s top airports. This chart shows how airports located in touristic hotspots (like Bariloche, Calafate, or Mendoza) didn’t take a hit as big as those with lesser touristic appeal. This can be sourced to a holiday season with fewer restrictions (COVID-19 were low all throughout the summer) and government plans to promote domestic travel.

Comparing the same months of 2020 and 2021, the top ten airports that lost most passengers are the following: El Palomar (ceased operations as commercial airport in March 2020), Formosa (down 98%), La Rioja (-95%), Puerto Madryn (-90%), Rosario, falling 81%, Iguazú (-73%), Aeroparque and Córdoba (both losing 71% of their traffic), Paraná (-69%), Bahía Blanca (-67%) and Mar del Plata (-64%).

Conclusion

We can observe from the available data that passenger travel in Argentina is yet to start its recovery. Even though the summer holiday season saw the downfall stall and even rebound, when the pandemic’s second wave hit in April, traffic resumed its downward trend.

As of the writing of this article, Argentina’s market future is more filled with doubts than certainties.

/https://aviacionlinecdn.eleco.com.ar/media/2018/11/Flybondi-vuelo-inaugural-Corrientes-Cordoba-01NOV2018-24.jpg)

Para comentar, debés estar registradoPor favor, iniciá sesión