American Airlines Net Income Surges to USD 1.3 Billion in Q2 2023

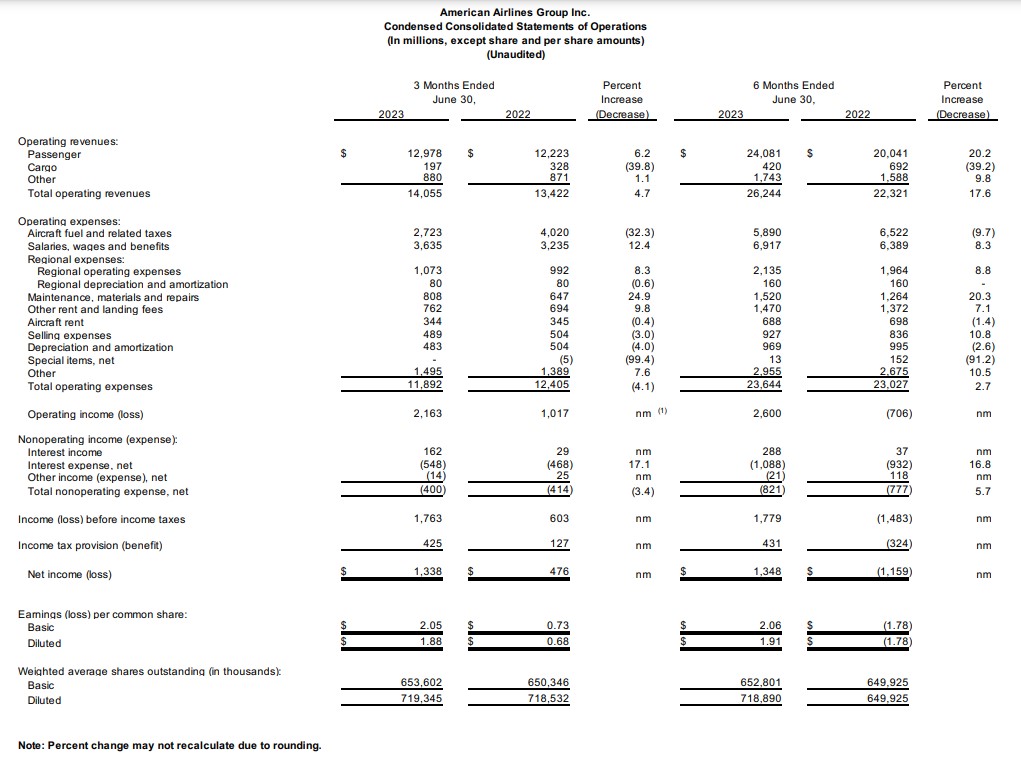

American Airlines has released its second-quarter 2023 financial and operational results, showcasing positive performance across key metrics. With record quarterly revenue of $14.1 billion, representing a 4.7% year-over-year increase, the airline reported strong financial gains. The net income for the quarter was $1.3 billion, or $1.88 per diluted share. Excluding net special items, the net income stood at $1.4 billion, or $1.92 per diluted share. Operating cash flow reached $1.8 billion, while free cash flow amounted to $1.2 billion. The company concluded the quarter with total available liquidity of $14.9 billion.

Robert Isom, CEO of American Airlines, expressed satisfaction with the results, attributing the success to the team’s dedication in ensuring a reliable operation and meeting the robust demand for their services. Isom emphasized the airline’s commitment to maintaining a strong operation, fleet modernization, and expanding their global network, all of which contributed to the record-breaking revenues in the second quarter. Moving forward, American Airlines aims to build on this momentum by prioritizing reliability, profitability, accountability, and strengthening their balance sheet.

Throughout the second quarter, American Airlines achieved notable operational milestones, including their best-ever second-quarter completion factor and controllable completion factor. Operating nearly 500,000 flights with an average load factor of approximately 86%, the airline demonstrated a strong operational performance.

The Memorial Day weekend saw a record mainline completion factor, followed by a record June completion factor, despite challenges posed by weather conditions and air traffic control. American Airlines also achieved their best-ever controllable completion factors in April, May, and June, with 11 more combined zero-cancellation days compared to the same period in the previous year.

The airline’s strong revenue performance was driven by broad-based demand strength and the solid completion factor performance. Notably, June witnessed a surge in close-in bookings, contributing to the overall growth. Domestic and short-haul international revenue remained robust, and there was noticeable strength in long-haul international demand and yield performance. American Airlines reported an operating margin of 15.4% and a net income of $1.3 billion on a GAAP basis. Excluding net special items, the net income for the quarter was $1.4 billion.

Strengthening the balance sheet continues to be a top priority for American Airlines. In the second quarter, the company generated $1.8 billion in operating cash flow and $1.2 billion in free cash flow. Additionally, the company reduced its total debt by $387 million, bringing the reduction to approximately $9.4 billion from peak levels in mid-2021. Fitch, a credit rating agency, recognized American Airlines’ commitment to improving its financial position by upgrading the company’s rating two notches to B+. The airline concluded the quarter with approximately $14.9 billion in total available liquidity, comprising cash, short-term investments, and undrawn capacity under revolving and other short-term credit facilities.

Based on demand trends and fuel price forecasts, American Airlines provided guidance for the third quarter and updated its full-year 2023 adjusted earnings per diluted share expectations. The company expects its third-quarter adjusted earnings per diluted share to range between $0.85 and $0.95. The full-year adjusted earnings per diluted share guidance has been revised to a range of $3.00 to $3.75. These forecasts include the estimated impact of anticipated new labor agreements.

Operating Results

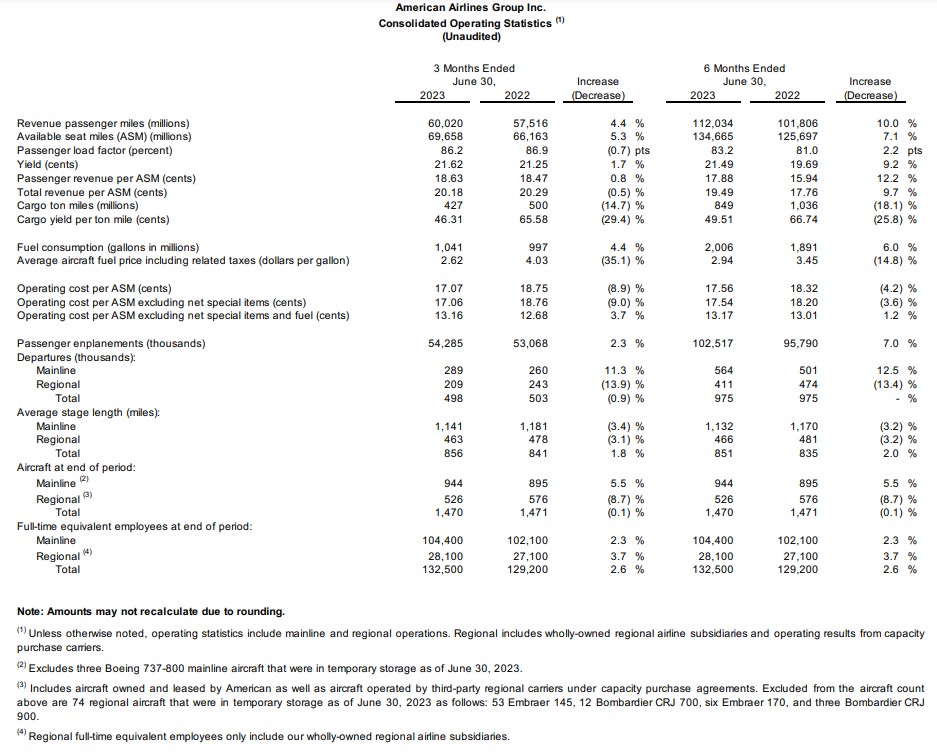

During the second quarter of 2023, American Airlines transported 54.28 million passengers, a 2.3% increase compared to the same period in 2022. Capacity, measured in available seat miles (ASM), grew by 4.4%, while demand, measured in revenue passenger miles (RPM), increased by 5.3%, resulting in an occupancy factor of 86.2% (-0.7 percentage points). The yield grew by 1.7%, reaching 21.62 cents per dollar.

At the end of the quarter, American Airlines’ fleet comprised 944 aircraft, with an additional 526 aircraft in the regional segment through subsidiaries or companies with capacity purchase agreements.

American Airlines in Latin America and the Caribbean

The company experienced a 5.9% decline in demand (RPM) on its flights to Latin America and the Caribbean, while capacity (ASM) was reduced by 6.1%, resulting in a 0.2 percentage point increase in the occupancy factor, which reached 86.2%. The yield stood at 20.69 cents per dollar, a 13.6% increase compared to the second quarter of 2022.

In the first half of the year, American Airlines’ capacity in the region (ASM) was adjusted by 2%, but demand (RPM) grew by 5.3%, leading to a 6 percentage point increase in the occupancy factor, reaching 85.9%. The yield grew by 22.2% to reach 20.99 cents per dollar.

/https://aviacionlinecdn.eleco.com.ar/aviacionline-static/images/logo.png)

Para comentar, debés estar registradoPor favor, iniciá sesión